FINRA-Registered Representatives

Table of Contents

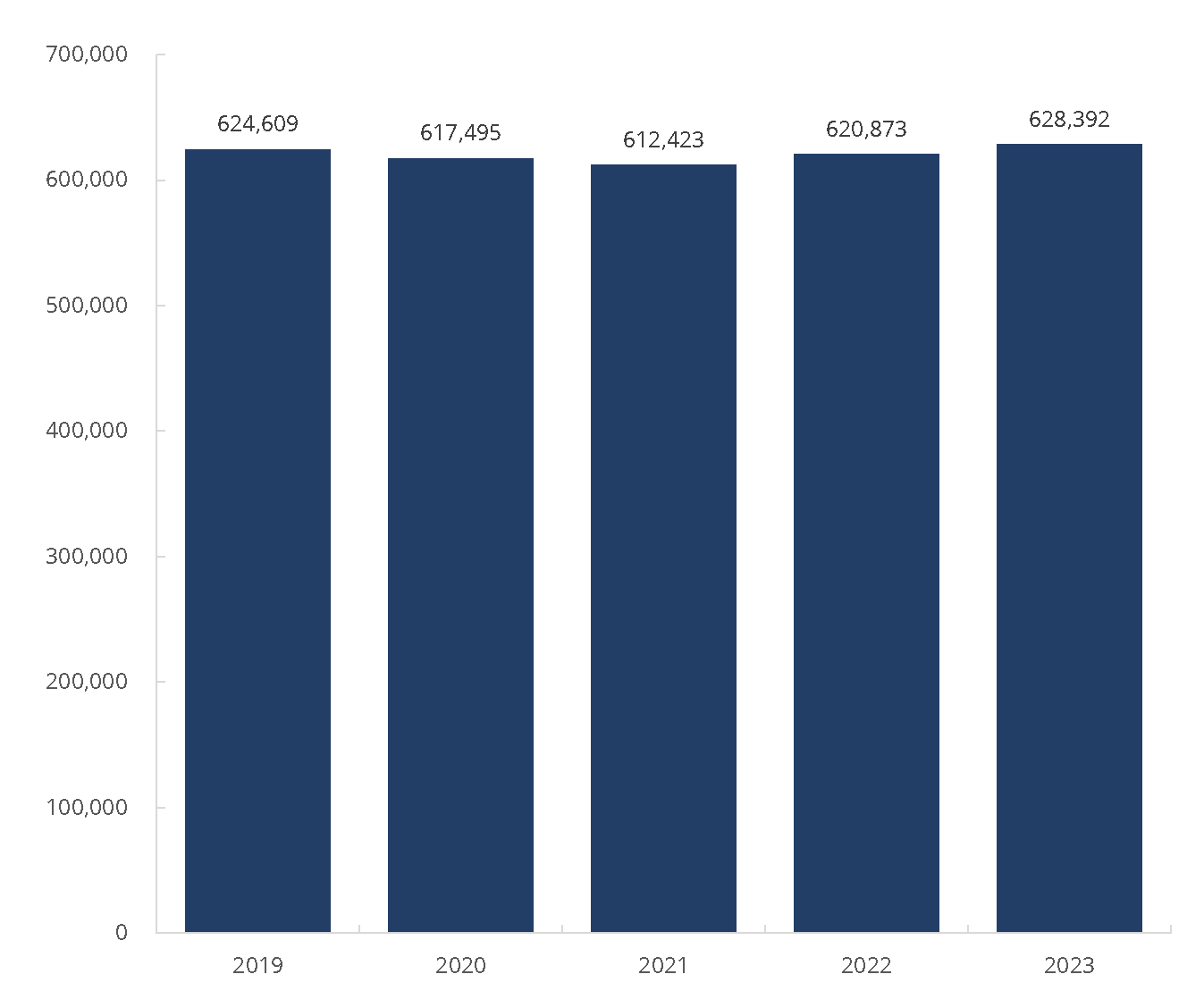

- Figure 1.1.1 Total Number of FINRA-Registered Representatives, 2019–2023

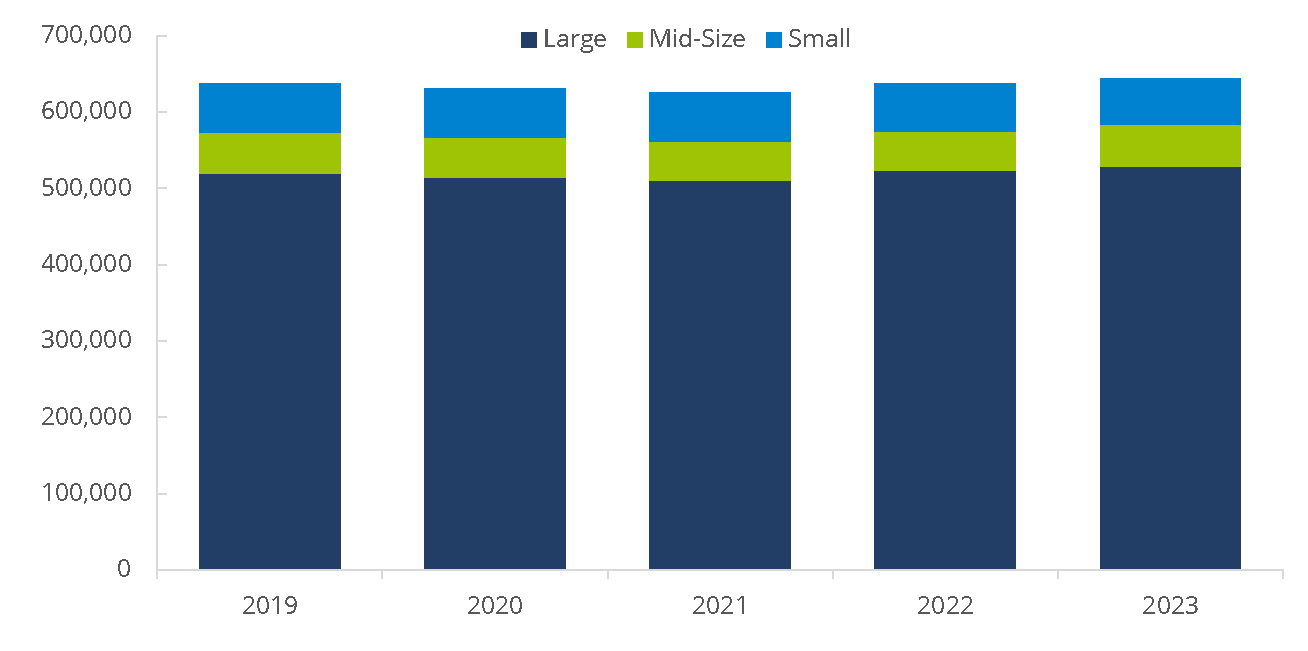

- Figure 1.1.2 FINRA-Registered Representatives by Firm Size, 2019–2023

- Table 1.1.3 FINRA-Registered Representatives by Firm Size, 2019–2023

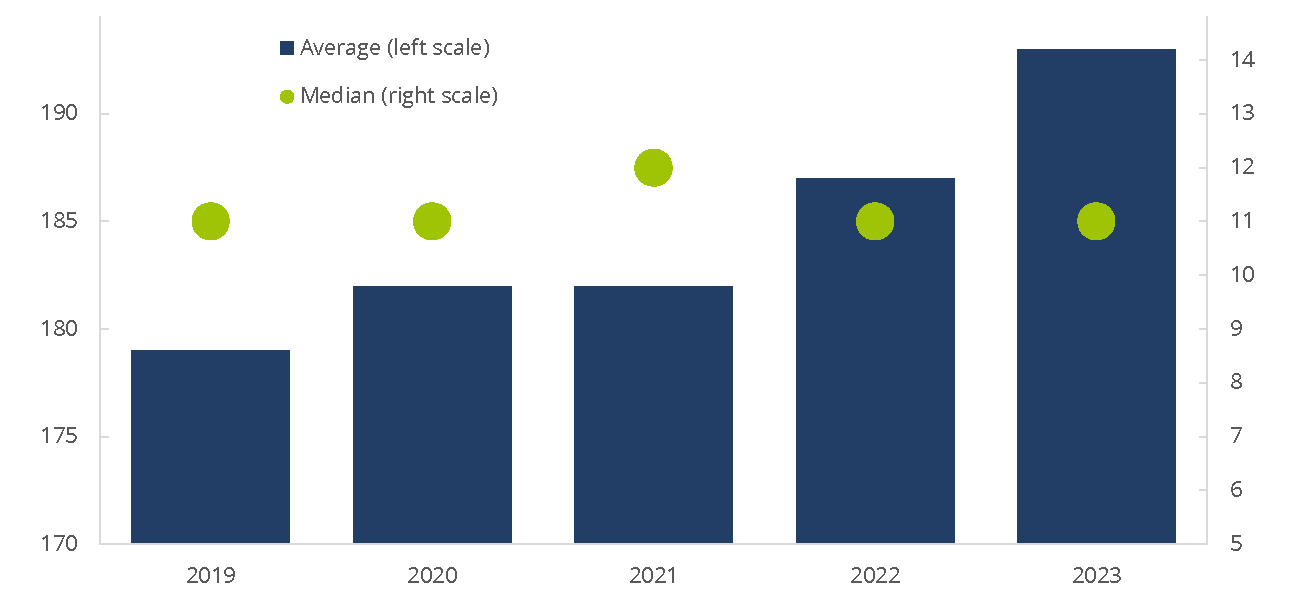

- Figure 1.1.4 Average and Median Number of FINRA-Registered Representatives per Firm, 2019–2023

- Table 1.1.5 Average and Median Number of FINRA-Registered Representatives per Firm, 2019–2023

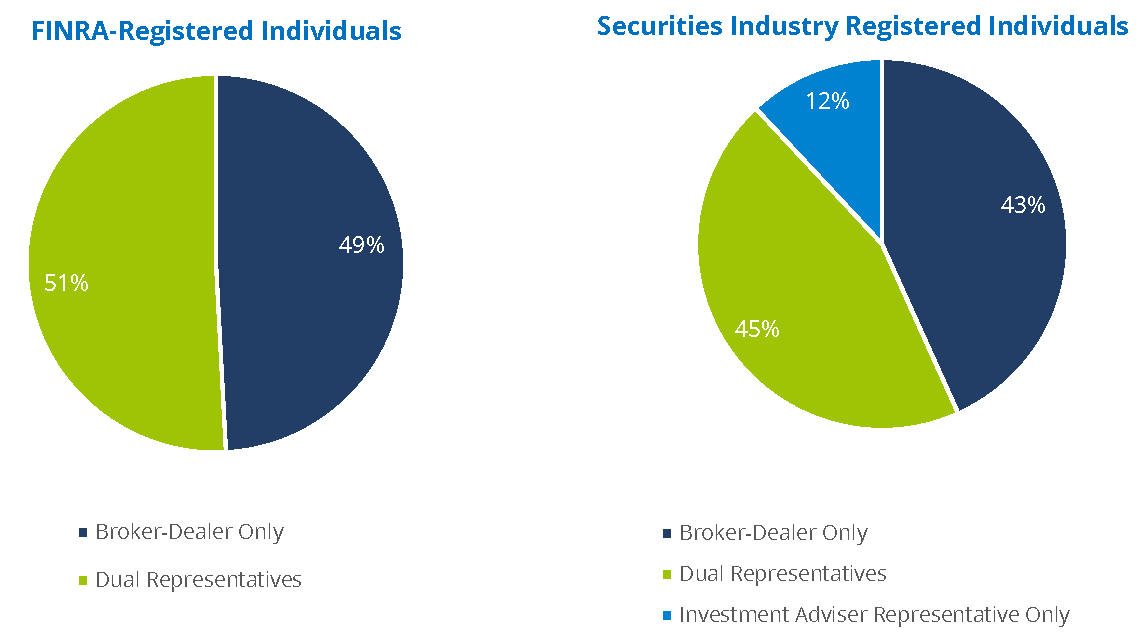

- Figure 1.1.6 Registered Individuals by Type of Registration, 2023

- Table 1.1.7 Securities Industry Registered Individuals by Type of Registration, 2023

- Figure 1.1.8 Securities Industry Registered Individuals by Type of Registration, 2014–2023

- Figure 1.2.1 FINRA-Registered Representatives – Leaving/Entering FINRA Membership, 2009–2023

- Table 1.2.2 FINRA-Registered Representatives – Leaving/Entering FINRA Membership, 2009–2023

- Figure 1.2.3 Firm Size Distribution of FINRA-Registered Representatives Leaving/Entering FINRA Membership, 2009–2023

- Figure 1.2.4 Securities Industry Registered Individuals’ Transfers Between Firms within the Industry, 2018–2023

- Figure 1.2.5 Securities Industry Registered Individuals’ Transfers Between Firms by Registration Type, 2018–2023

- Figure 1.3.1 Geographic Distributions of State Level Registrations, 2023

- Table 1.3.2 Geographic Distributions of Region Level Registrations, 2019−2023

1.1 Sizes and Counts

Anyone actively involved in a FINRA-registered firm’s investment banking or securities business must be registered as a representative with FINRA (FINRA-registered representative). To become registered, securities professionals are required to pass qualification exams to demonstrate competence in their particular securities activities. A FINRA-registered representative’s duties may include supervision, sales of securities or training of persons associated with the member firm.

Figure 1.1.1 Total Number of FINRA-Registered Representatives, 2019–2023

(Counts as of year-end)

Source: Financial Industry Regulatory Authority.

Figure 1.1.2 FINRA-Registered Representatives by Firm Size, 2019–20231

(Counts as of year-end)

Source: Financial Industry Regulatory Authority.

1Registrations by firm size differ from the total number of registrations as individuals registered with multiple firms are counted for each firm they represent, potentially in the same size class or in multiple size classes depending on the sizes of the employing firms. Large firm = 500 or more registered representatives; Mid-Size firm = 151-499 registered representatives; Small firm = 1-150 registered representatives.

Table 1.1.3 FINRA-Registered Representatives by Firm Size, 2019–20231

(Counts as of year-end)

2019 | 2020 | 2021 | 2022 | 2023 | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

Firm Size | Total | % | Total | % | Total | % | Total | % | Total | % |

Large | 519,676 | 81.5% | 513,888 | 81.5% | 510,158 | 81.5% | 524,063 | 82.3% | 528,840 | 82.1% |

Mid-Size | 53,762 | 8.4% | 52,484 | 8.3% | 51,007 | 8.1% | 50,886 | 8.0% | 54,767 | 8.5% |

Small | 64,165 | 10.1% | 64,098 | 10.2% | 64,863 | 10.4% | 62,078 | 9.7% | 60,683 | 9.4% |

Total | 637,603 | 100.0% | 630,470 | 100.0% | 626,028 | 100.0% | 637,027 | 100.0% | 644,290 | 100.0% |

Source: Financial Industry Regulatory Authority.

1Registrations by firm size differ from the total number of registrations as individuals registered with multiple firms are counted for each firm they represent, potentially in the same size class or in multiple size classes depending on the sizes of the employing firms. Large firm = 500 or more registered representatives; Mid-Size firm = 151-499 registered representatives; Small firm = 1-150 registered representatives.

Figure 1.1.4 Average and Median Number of FINRA-Registered Representatives per Firm, 2019–2023

(Counts as of year-end)

Source: Financial Industry Regulatory Authority.

Table 1.1.5 Average and Median Number of FINRA-Registered Representatives per Firm, 2019–2023

(Counts as of year-end)

| 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

Average | 179 | 182 | 182 | 187 | 193 |

Median | 11 | 11 | 12 | 11 | 11 |

Source: Financial Industry Regulatory Authority

Figure 1.1.6 Registered Individuals by Type of Registration, 20231,2

Source: Financial Industry Regulatory Authority.

1Owners of investment advisory firms may be exempt from registering as Investment Adviser Representatives. Accordingly, these Investment Adviser Representatives are not included in the table.

2"Broker Dealer Representatives Only" refers to FINRA-registered representatives. "Dual Representatives" refers to FINRA-registered representatives who are also registered as investment adviser representatives. "Investment Adviser Representatives Only" refers to individuals who are registered only as investment adviser representatives and are overseen by the SEC or state regulators. "Securities Industry Registered Persons" represents the totality of registered individuals. Individuals are counted only once regardless of how many firms they represent. FINRA captures requirements on all Securities Registered Persons, including those that are not "FINRA-registered representatives."

Table 1.1.7 Securities Industry Registered Individuals by Type of Registration, 20231,2

(Counts as of year-end)

Total Number of Individuals | |

|---|---|

| Broker-Dealer Only | 308,795 |

| Dual Broker-Dealer Investment Adviser Representative | 319,597 |

| All BD Registered Individuals | 628,392 |

| Investment Adviser Representative Only | 85,184 |

| Total Registered Individuals | 713,576 |

Source: Financial Industry Regulatory Authority.

1Owners of investment advisory firms may be exempt from registering as Investment Adviser Representatives. Accordingly, these Investment Adviser Representatives are not included in the table.

2"Broker Dealer Representatives Only" refers to FINRA-registered representatives. "Dual Representatives" refers to FINRA-registered representatives who are also registered as investment adviser representatives. "Investment Adviser Representatives Only" refers to individuals who are registered only as investment adviser representatives and are overseen by the SEC or state regulators. "Securities Industry Registered Persons" represents the totality of registered individuals. Individuals are counted only once regardless of how many firms they represent. FINRA captures requirements on all Securities Registered Persons, including those that are not "FINRA-registered representatives."

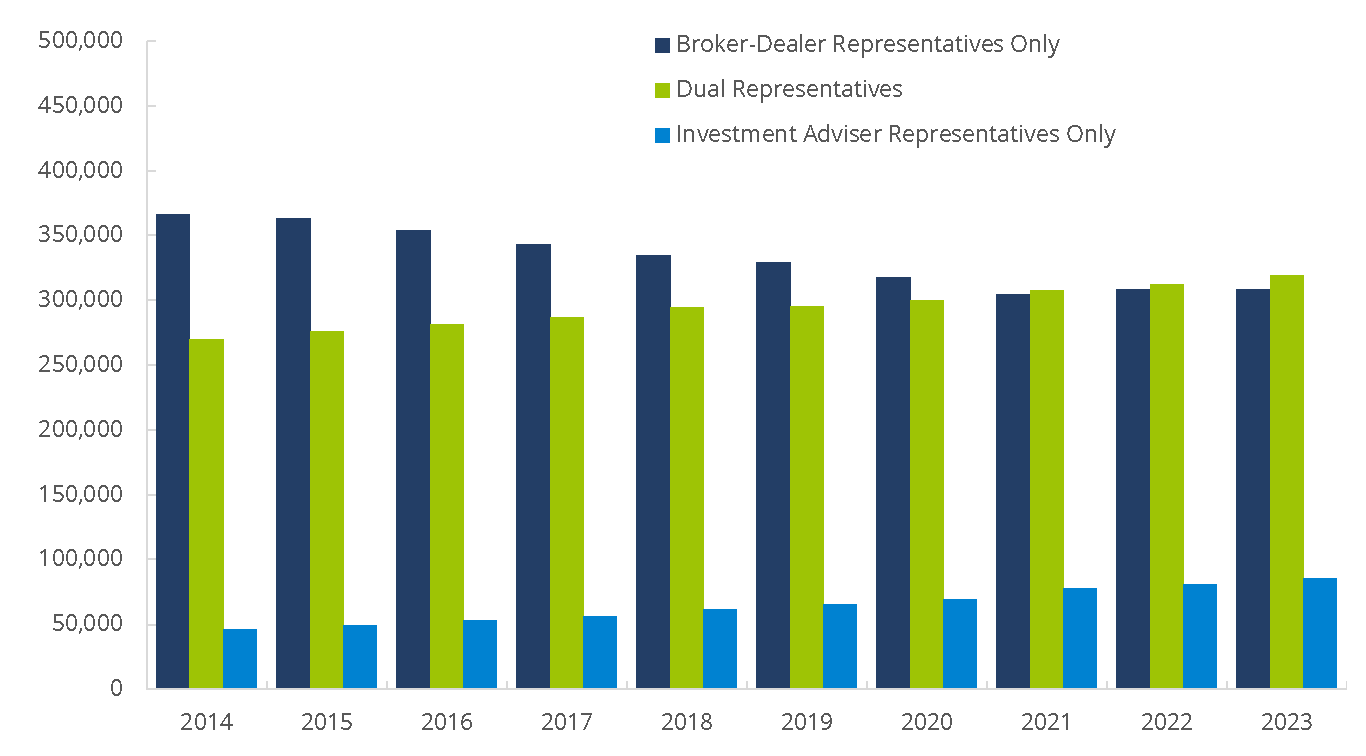

Figure 1.1.8 Securities Industry Registered Individuals by Type of Registration, 2014–20231,2

(Counts as of year-end)

Source: Financial Industry Regulatory Authority.

1Investment adviser representatives who solely dealt with customers in New York prior to February 1, 2021, or who were solely dealing with customers in Wyoming prior to July 1, 2017, are not captured in the Central Registration Depository (CRD) system. Furthermore, owners of investment advisory firms may be exempt from registering as Investment Adviser Representatives. Accordingly, these Investment Adviser Representatives are not included in the table.

2"Broker Dealer Representatives Only" refers to FINRA-registered representatives. "Dual Representatives" refers to FINRA-registered representatives who are also registered as investment adviser representatives. "Investment Adviser Representatives Only" refers to individuals who are registered only as investment adviser representatives and are overseen by the SEC or state regulators. "Securities Industry Registered Persons" represents the totality of registered individuals. Individuals are counted only once regardless of how many firms they represent. FINRA captures requirements on all Securities Registered Persons, including those that are not "FINRA-registered representatives."

1.2 Status Changes

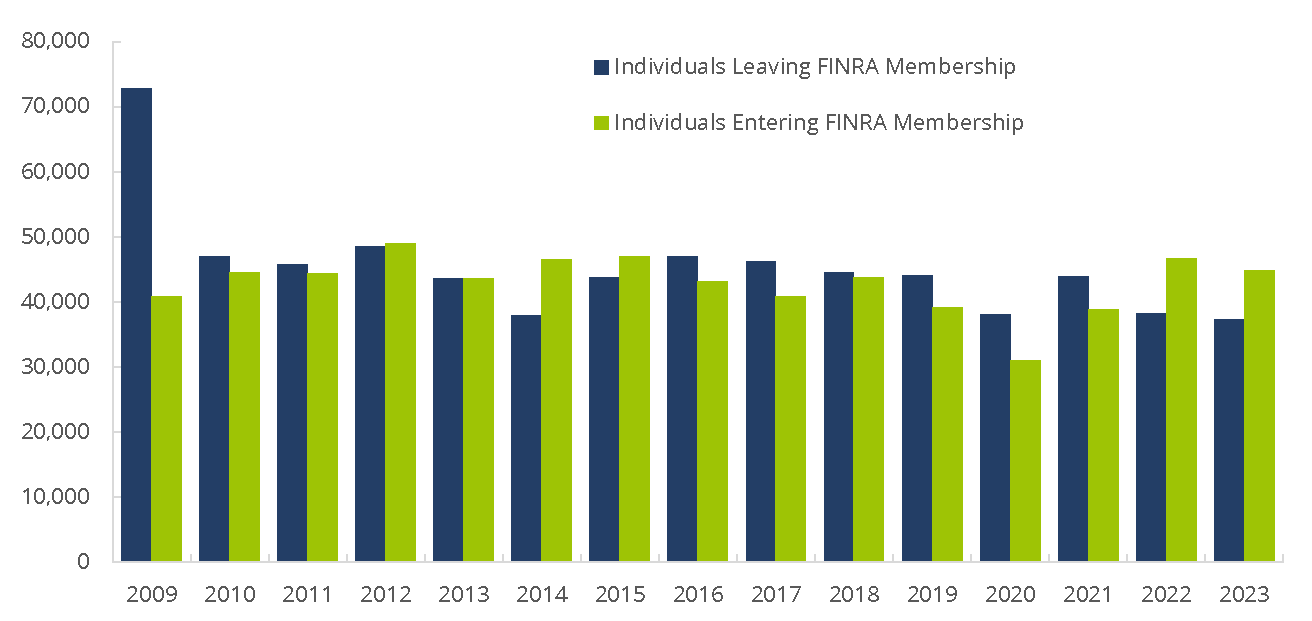

Figure 1.2.1 FINRA-Registered Representatives – Leaving/Entering FINRA Membership, 2009–2023

(Counts as of year-end)

Source: Financial Industry Regulatory Authority.

Table 1.2.2 FINRA-Registered Representatives – Leaving/Entering FINRA Membership, 2009–2023

(Counts as of year-end)

Year | Individuals Leaving | % of Total | Individuals Entering | % of Total | End-of-Year Total Registered Representatives |

|---|---|---|---|---|---|

2009 | 72,862 | 12% | 40,869 | 6% | 630,896 |

2010 | 47,092 | 7% | 44,649 | 7% | 628,453 |

2011 | 45,779 | 7% | 44,381 | 7% | 627,055 |

2012 | 48,592 | 8% | 49,009 | 8% | 627,472 |

2013 | 43,647 | 7% | 43,643 | 7% | 627,468 |

2014 | 37,920 | 6% | 46,603 | 7% | 636,151 |

2015 | 43,777 | 7% | 47,035 | 7% | 639,409 |

2016 | 47,042 | 7% | 43,221 | 7% | 635,588 |

2017 | 46,284 | 7% | 40,901 | 6% | 630,205 |

2018 | 44,550 | 7% | 43,810 | 7% | 629,465 |

2019 | 44,102 | 7% | 39,246 | 6% | 624,609 |

2020 | 38,145 | 6% | 31,031 | 5% | 617,495 |

2021 | 43,893 | 7% | 38,821 | 6% | 612,423 |

2022 | 38,233 | 6% | 46,683 | 8% | 620,873 |

2023 | 37,346 | 6% | 44,865 | 7% | 628,392 |

Source: Financial Industry Regulatory Authority.

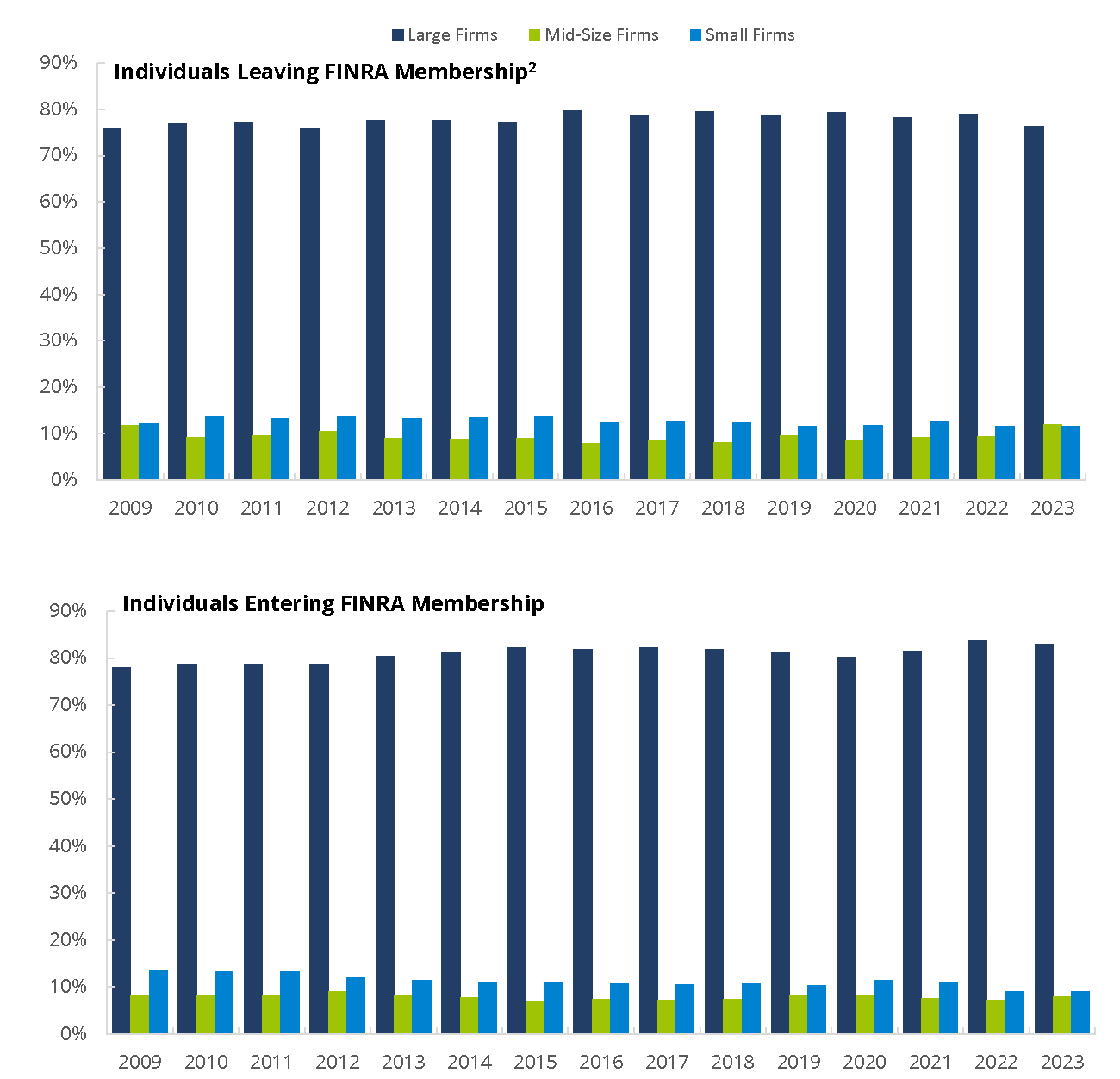

Figure 1.2.3 Firm Size Distribution of FINRA-Registered Representatives Leaving/Entering FINRA Membership, 2009–20231

(Percentage of total)

Source: Financial Industry Regulatory Authority.

1Individuals leaving and entering by firm size may differ from the total number of individuals entering and exiting FINRA membership as individuals registered with multiple firms are counted for each firm they represent, potentially in the same size class or in multiple size classes depending on the sizes of the employing firms. Large Firm = 500 or more registered representatives; Mid-Size Firm = 151-499 registered representatives; Small Firm = 1-150 registered representatives.

2An individual is considered to have left FINRA membership when the individual has no open registration with any FINRA approved member firm from the date of their last registration through the end of the next calendar year. Values for 2023 are estimates given that a full year's worth of 2024 data is required to compute individuals leaving the FINRA membership.

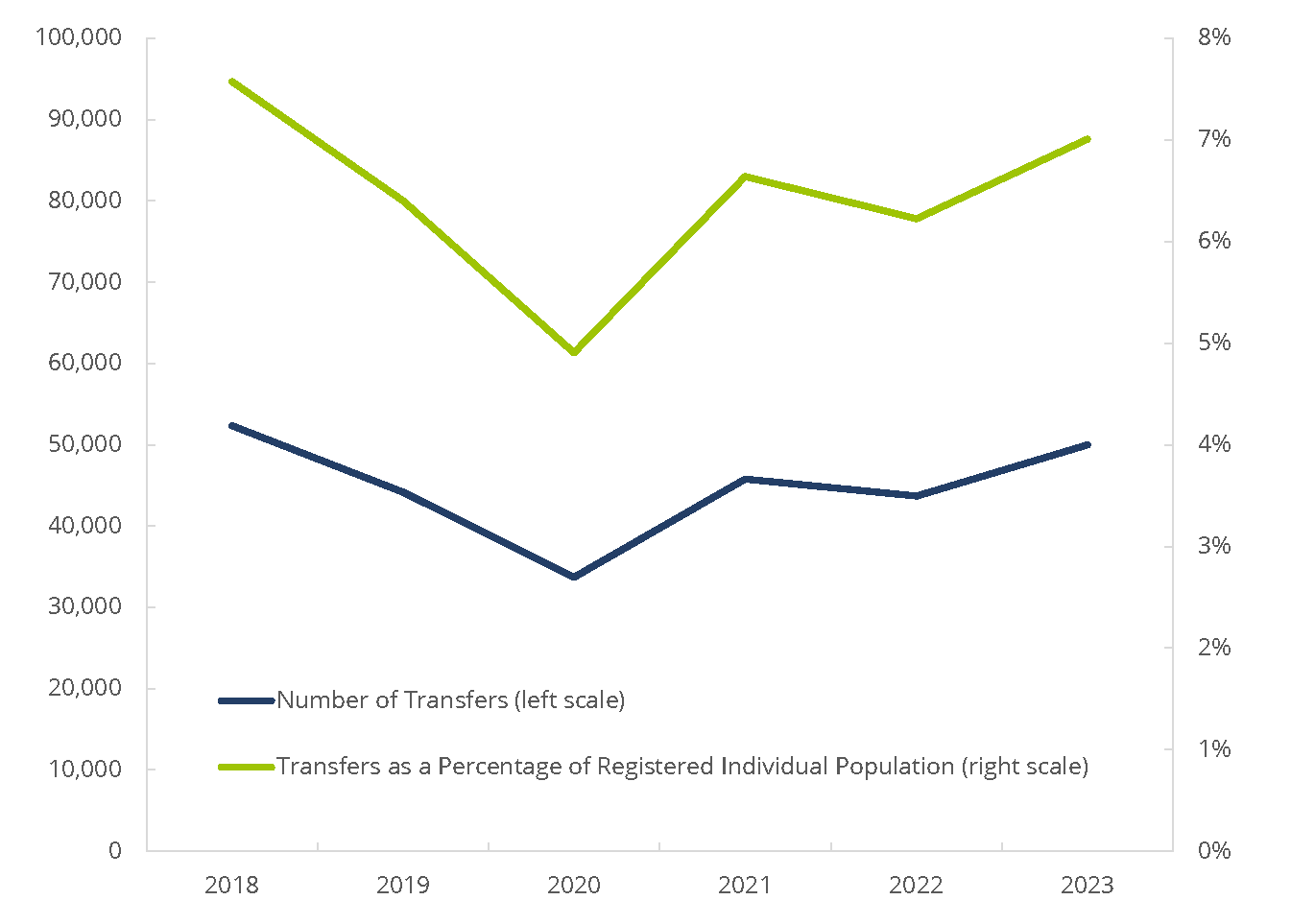

Figure 1.2.4 Securities Industry Registered Individuals’ Transfers Between Firms within the Industry, 2018–20231

(Counts as of year-end)

Source: Financial Industry Regulatory Authority.

1The number of transfers in a given year includes all transfers associated with Securities Industry Registered Individuals who dropped a registration with a firm and added a registration with another firm, irrespective of the individual's registration type, within 60 days before or 60 days after dropping the registration.

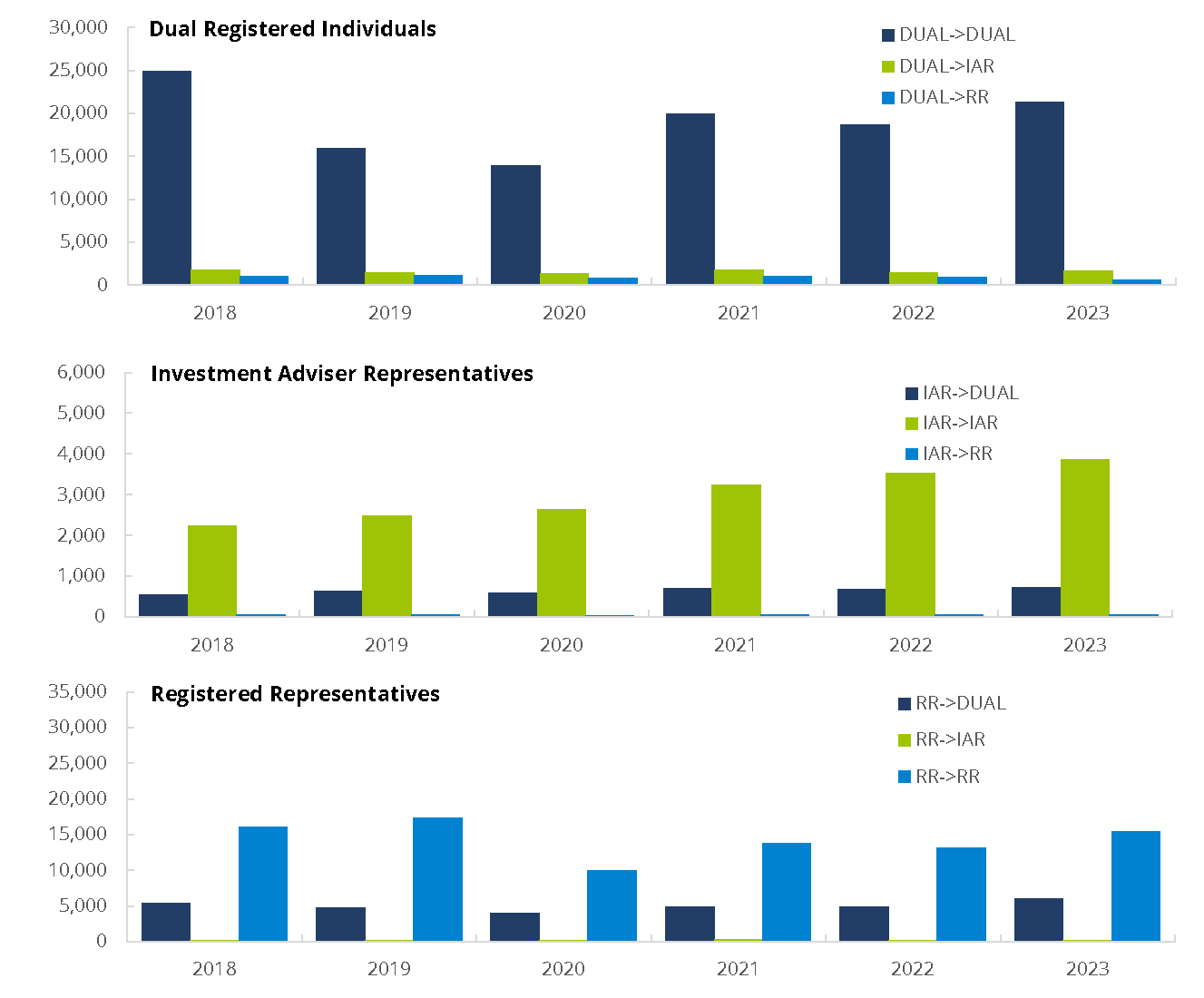

Figure 1.2.5 Securities Industry Registered Individuals’ Transfers Between Firms by Registration Type, 2018–20231,2

(Counts as of year-end)

Source: Financial Industry Regulatory Authority.

1Investment adviser representatives who solely dealt with customers in New York prior to February 1, 2021, or who were solely dealing with customers in Wyoming prior to July 1, 2017, are not captured in the Central Registration Depository (CRD) system. Furthermore, owners of investment advisory firms may be exempt from registering as Investment Adviser Representatives. Accordingly, these Investment Adviser Representatives are not included in the table.

2The number of transfers in a given year includes all transfers associated with Securities Industry Registered Individuals who dropped a registration with a firm and added a registration with a different firm within 60 days before or 60 days after dropping the registration. These transfers between firms include transfers from one registration type to another registration type (e.g. investment adviser registration at previous firm to registered representative registration at the new firm, "IAR -> RR"), as well as transfers for the same registration type (e.g. investment adviser registration at previous firm to same registration at the new firm, "IAR -> IAR").