Firm Data

Table of Contents

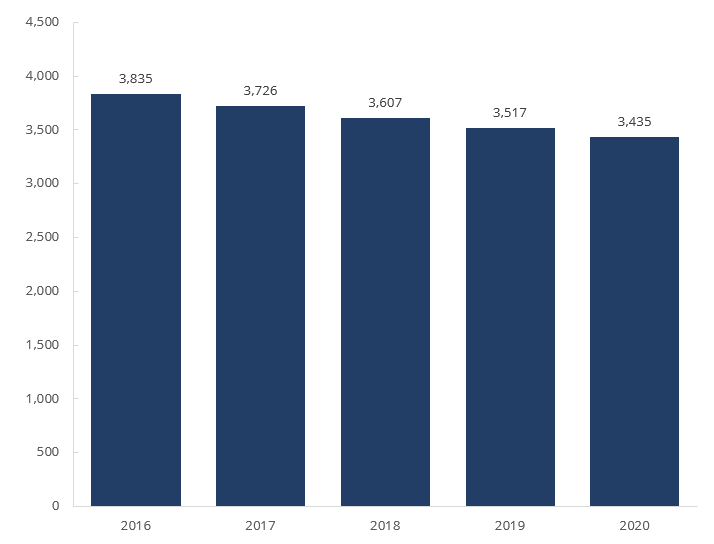

- Figure 2.1 Total Number of FINRA-Registered Firms, 2016−2020

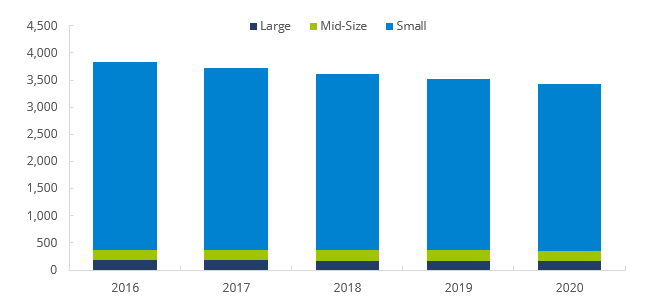

- Figure 2.2 Firm Distribution by Size, 2016−2020

- Table 2.2 Firm Distribution by Size, 2016−2020

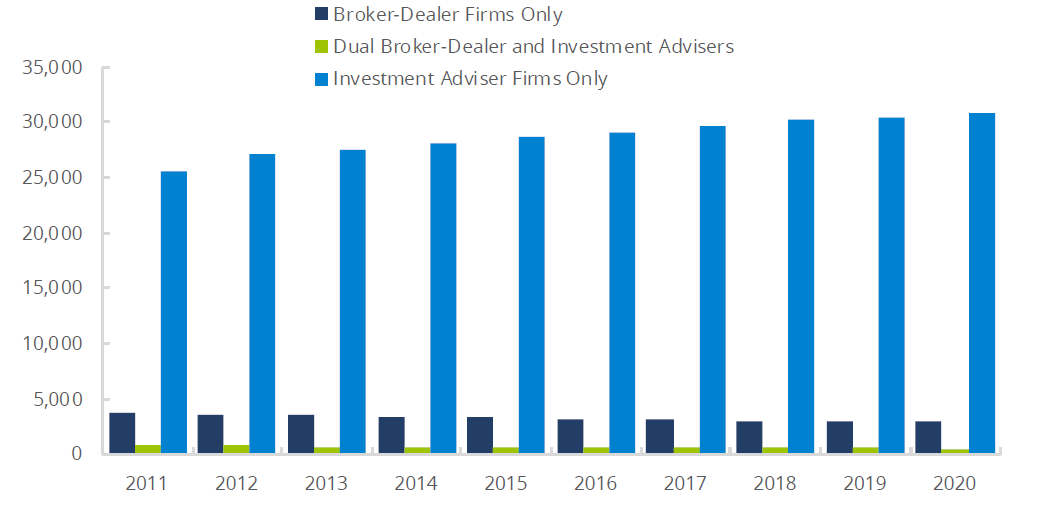

- Figure 2.3 Securities Industry Registered Firms by Type of Registration, 2011−2020

- Table 2.3 Securities Industry Registered Firms by Type of Registration, 2011−2020

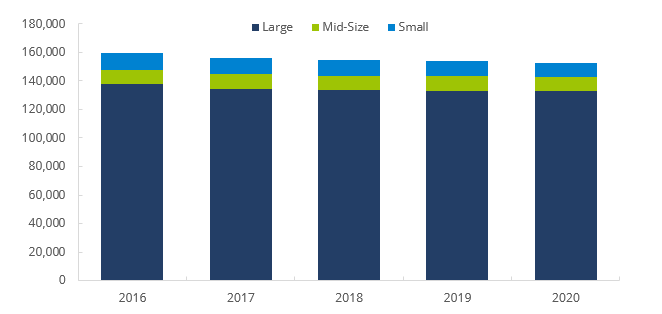

- Figure 2.4 Distribution of Branches by Firm Size, 2016−2020

- Table 2.4 Distribution of Branches by Firm Size, 2016−2020

- Figure 2.5 Firm Distribution by Specified Demographics, 2020

- Table 2.5 Firm Distribution by Number of Registered Representatives: Additional Breakdown, 2016–2020

- Figure 2.6 10-Year Change in Number of FINRA-Registered Firms, 2010−2020

- Figure 2.9 Urban-Rural Breakdown of FINRA-Registered Firms and Branches by Firm Size—2020

- Table 2.9 Urban-Rural Breakdown of FINRA-Registered Firms and Branches by Firm Size—2020

- Figure 2.10 FINRA-Registered Firms – Median Number of Years in Business, 2010–2020

- Figure 2.11 FINRA-Registered Firms – Revenues and Expenses, 2016–2020

- Table 2.11 FINRA-Registered Firms – Aggregate Financial Information, 2016–2020

- Figure 2.12 FINRA-Registered Firms – Leaving/Entering the Industry, 2006–2020

- Table 2.12 FINRA-Registered Firms – Leaving/Entering the Industry, 2006–2020

- Figure 2.13 FINRA-Registered Firm Branch Offices – Opening/Closing, 2006–2020

- Table 2.13 FINRA-Registered Firm Branch Offices – Opening/Closing, 2006–2020

- Figure 2.14 Spotlight: Capital Acquisition Brokers and Funding Portals, 2016–2020

- Figure 2.15 Advertising Regulation Filing Volumes, 2016–2020

- Table 2.15 FINRA-Registered Firms – Most Common Marketing Methods Filed with FINRA, 2020

- Figure 2.16 Advertising Regulation Filing Volumes – Investment Company Product, 2020

- Table 2.16 Advertising Regulation Filing Volumes – Investment Company Product, 2020

- Table 2.17 Advertising Regulation Filing Volumes – Voluntary vs. Mandatory, 2016–2020

- Table 2.18 Small Firms – Business Segments as of December 2020

- Table 2.19 Mid-Size Firms – Business Segments as of December 2020

- Table 2.20 Large Firms – Business Segments as of December 2020

- Table 2.21 Number of Unique Corporate Financing Filings, 2016–2020

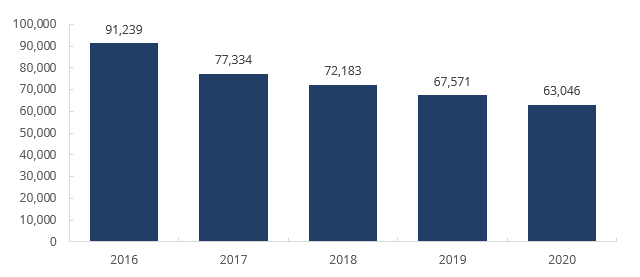

Figure 2.1 Total Number of FINRA-Registered Firms, 2016−20201

(Count as of year-end)

Source: Financial Industry Regulatory Authority.

1Firms conducting securities transactions and business with the investing public must be registered with FINRA. Firms must meet certain membership standards to attain registration.

Figure 2.2 Firm Distribution by Size, 2016−20201

(Count as of year-end)

Source: Financial Industry Regulatory Authority.

1Large Firm = 500 or more registered representatives; Mid-Size Firm = 151-499 registered representatives; Small Firm = 1-150 registered representatives.

Table 2.2 Firm Distribution by Size, 2016–20201

(Counts as of year-end)

| 2016 | 2017 | 2018 | 2019 | 2020 | |

| Large | 179 | 178 | 173 | 168 | 165 |

| Mid-Size | 194 | 195 | 192 | 198 | 191 |

| Small | 3,462 | 3,353 | 3,242 | 3,151 | 3,079 |

| Total | 3,835 | 3,726 | 3,607 | 3,517 | 3,435 |

Source: Financial Industry Regulatory Authority. Data as of December 31, 2020.

1Large Firm = 500 or more registered representatives; Mid-Size Firm = 151-499 registered representatives; Small Firm = 1-150

Figure 2.3 Securities Industry Registered Firms by Type of Registration, 2011−20201

(Count as of year-end)

Source: Financial Industry Regulatory Authority.

1"Broker-Dealer Firms Only" refers to firms that are solely registered with FINRA as broker-dealers. "Dual Broker-Dealer and Investment-Adviser Firms" refers to FINRA-registered broker-dealers who are also registered as investment adviser firms. "Investment Adviser Firms Only" refers to firms that are registered only as investment advisers and are overseen by the SEC or state regulators. "Securities Industry Registered Firms" refers to the totality of registered firms.

Table 2.3 Securities Industry Registered Firms by Type of Registration, 2011–20201

(Counts as of year-end)

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

| Broker-Dealer Firms Only | 3,673 | 3,545 | 3,449 | 3,391 | 3,303 | 3,226 | 3,130 | 3,045 | 2,989 | 2,930 |

| Dual Broker-Dealer and Investment-Adviser Firms | 782 | 744 | 697 | 677 | 640 | 609 | 596 | 562 | 528 | 505 |

| All FINRA-Registered Broker-Dealer Firms | 4,455 | 4,289 | 4,146 | 4,068 | 3,943 | 3,835 | 3,726 | 3,607 | 3,517 | 3,435 |

| Investment Adviser Firms Only | 25,524 | 27,131 | 27,511 | 28,135 | 28,712 | 29,081 | 29,600 | 30,246 | 30,534 | 30,888 |

| Total Registered Firms | 29,979 | 31,420 | 31,657 | 32,203 | 32,655 | 32,916 | 33,326 | 33,853 | 34,051 | 34,323 |

Source: Financial Industry Regulatory Authority.

1"Broker-Dealer Firms Only" refers to firms that are solely registered with FINRA as broker-dealers. "Dual Broker-Dealer and Investment-Adviser Firms" refers to FINRA-registered broker-dealers who are also registered as investment adviser firms. "Investment Adviser Firms Only" refers to firms that are registered only as investment advisers and are overseen by the SEC or state regulators. "Securities Industry Registered Firms" refers to the totality of registered firms.

Figure 2.4 Firm Distribution by Number of Branches, 2016−20201,2

(Count as of year-end)

Source: Financial Industry Regulatory Authority.

1For each branch office, a FINRA-registered firm must file a Form BR (the Uniform Branch Office Registration Form).

2Large Firm = 500 or more registered representatives; Mid-Size Firm = 151-499 registered representatives; Small Firm = 1-150 registered representatives.

Table 2.4 Firm Distribution by Number of Branches, 2016–20201,2

(Counts as of year-end)

| 2016 | 2017 | 2018 | 2019 | 2020 | |

| Large | 137,806 | 134,473 | 133,760 | 132,758 | 132,719 |

| Mid-Size | 10,137 | 10,216 | 9,837 | 10,660 | 9,766 |

| Small | 11,521 | 11,278 | 11,064 | 10,489 | 10,376 |

| Total | 159,464 | 155,967 | 154,661 | 153,907 | 152,861 |

Source: Financial Industry Regulatory Authority.

1For each branch office, a FINRA-registered firm must file a Form BR (the Uniform Branch Office Registration Form).

2Large Firm = 500 or more registered representatives; Mid-Size Firm = 151-499 registered representatives; Small Firm = 1-150 registered representatives.

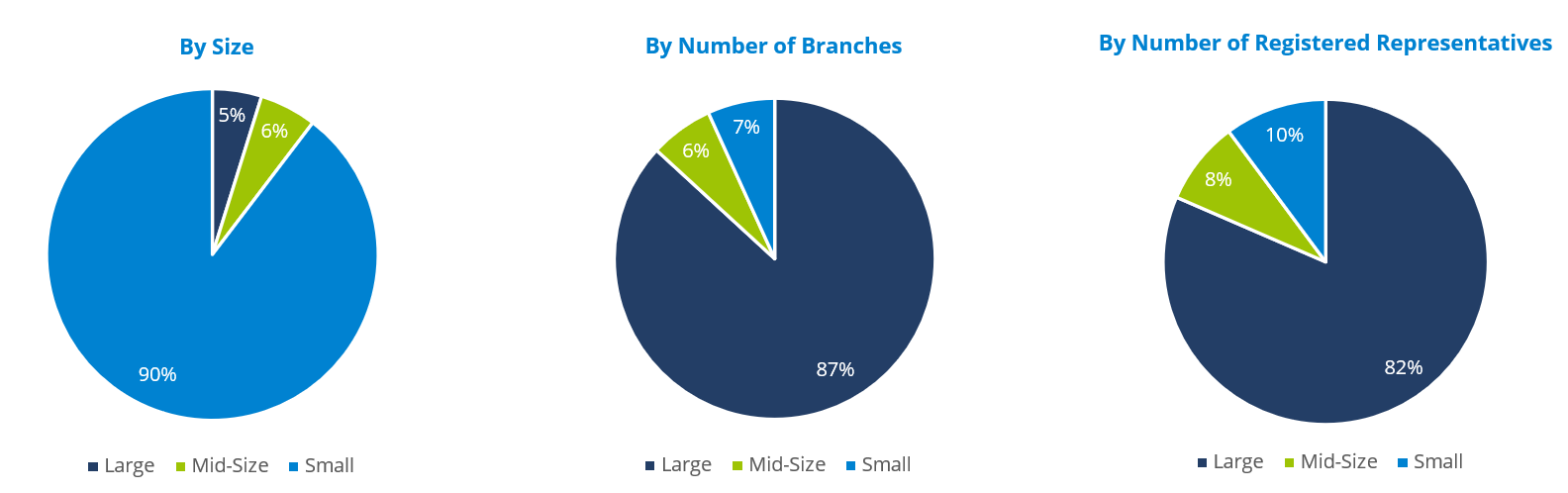

Figure 2.5 Firm Distribution by Specified Demographics, 2020

(As of year-end, percent of total)

Source: Financial Industry Regulatory Authority.

Table 2.5 Firm Distribution by Number of Registered Representatives: Additional Breakdown, 2016–2020

(Counts as of year-end)

| Size Category | 2016 | 2017 | 2018 | 2019 | 2020 |

| >1000 | 102 | 99 | 93 | 95 | 93 |

| 500-1000 | 77 | 79 | 80 | 73 | 72 |

| 301-499 | 69 | 67 | 65 | 69 | 66 |

| 151-300 | 125 | 128 | 127 | 129 | 125 |

| 101-150 | 100 | 102 | 101 | 107 | 112 |

| 76-100 | 101 | 85 | 94 | 83 | 78 |

| 51-75 | 164 | 161 | 165 | 157 | 174 |

| 41-50 | 107 | 116 | 100 | 100 | 102 |

| 31-40 | 166 | 166 | 167 | 159 | 133 |

| 26-30 | 109 | 118 | 129 | 114 | 119 |

| 21-25 | 167 | 167 | 155 | 164 | 124 |

| 16-20 | 254 | 260 | 257 | 236 | 248 |

| 11-15 | 405 | 378 | 378 | 370 | 374 |

| 10 or Fewer | 1,889 | 1,800 | 1,696 | 1,661 | 1,615 |

| Total | 3,835 | 3,726 | 3,607 | 3,517 | 3,435 |

Source: Financial Industry Regulatory Authority.

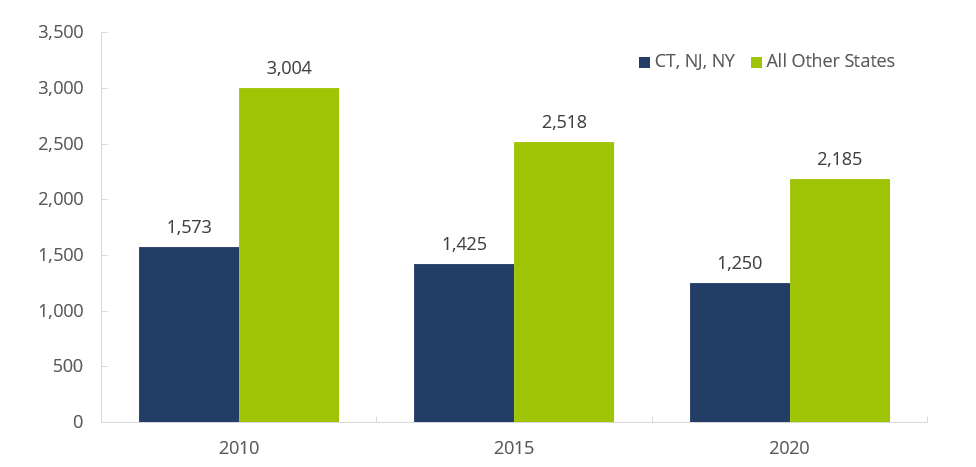

Figure 2.6 10-Year Change in Number of FINRA-Registered Firms, 2010−2020

(Count as of year-end)

Source: Financial Industry Regulatory Authority.

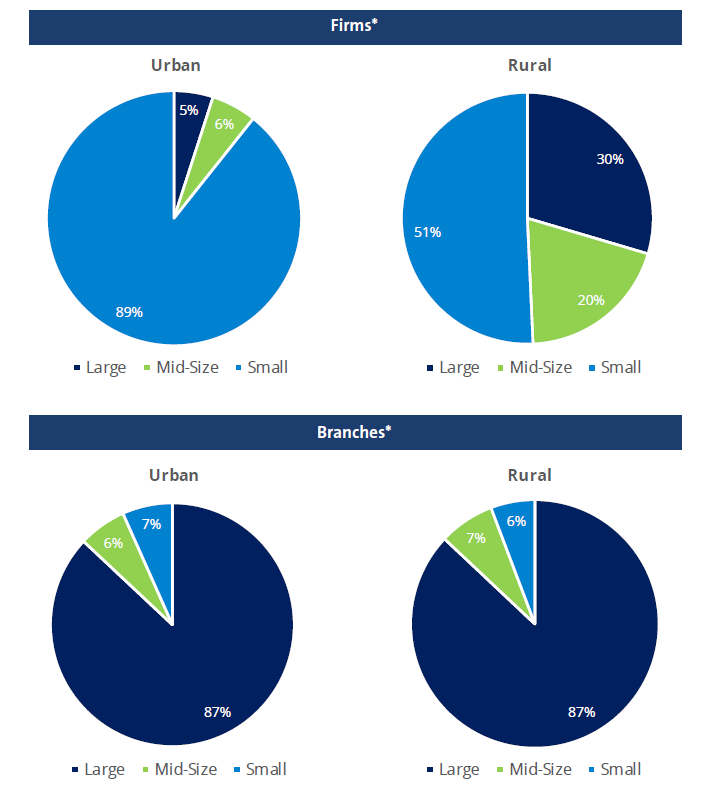

Figure 2.9 Urban-Rural Breakdown of FINRA-Registered Firms and Branches by Firm Size–20201,2

(Percent of total, as of year-end)

Source: U.S. Census Bureau and FINRA staff calculations.

1Large Firm = 500 or more registered representatives; Mid-Size Firm = 151-400 registered representatives; Small Firm = 1-150 registered representatives.

2Branch and firm zip codes are linked to the 2010 Urban Area to Zip Code Tabulation Area (ZCTA) Relationship File. The Census Bureau identifies two types of urban areas: i) Urbanized Areas (UAs) of 50,000 or more people; ii) Urban Clusters (UCs) of at least 2,500 and less than 50,000 people. "Rural" encompasses all population, housing, and territory not included within an urban area.

Table 2.9 Urban-Rural Breakdown of FINRA-Registered Firms and Branches by Firm Size—20201,2

(Count as of year-end)

| Firms* | Branches* | |||||||

| Urban | % Urban | Rural | % Rural | Urban | % Urban | Rural | % Rural | |

| Large | 165 | 5% | 123 | 30% | 128,392 | 87% | 4,238 | 87% |

| Mid-Size | 190 | 6% | 82 | 20% | 9,360 | 6% | 352 | 7% |

| Small | 2,963 | 89% | 211 | 51% | 9,823 | 7% | 280 | 6% |

| Total | 3,318 | 100% | 416 | 100% | 147,575 | 100% | 4,870 | 100% |

Source: U.S. Census Bureau;and FINRA staff calculations.

*A firm is counted if it has a branch in that area. Not included are firms and branches that do not report a zip code in CRD.

1Large Firm = 500 or more registered representatives; Mid-Size Firm = 151-400 registered representatives; Small Firm = 1-150 registered representatives.

2Branch and firm zip codes are linked to the 2010 Urban Area to Zip Code Tabulation Area (ZCTA) Relationship File. The Census Bureau identifies two types of urban areas: i) Urbanized Areas (UAs) of 50,000 or more people; ii) Urban Clusters (UCs) of at least 2,500 and less than 50,000 people. "Rural" encompasses all population, housing, and territory not included within an urban area.

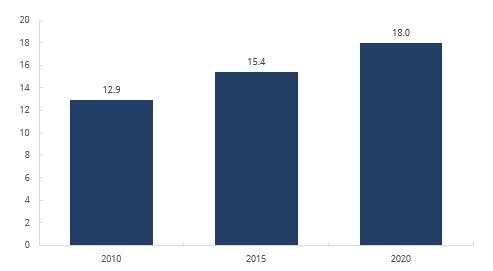

Figure 2.10 FINRA-Registered Firms – Median Number of Years in Business, 2010−2020

(Count as of year-end)

Source: Financial Industry Regulatory Authority.

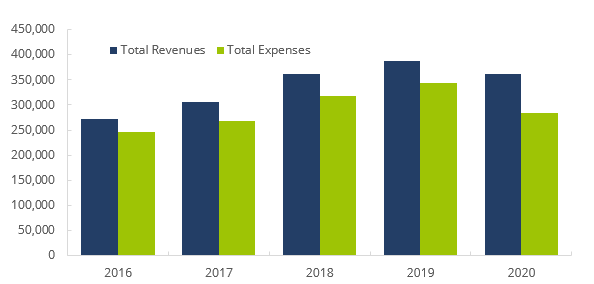

Figure 2.11 FINRA-Registered Firms – Revenues and Expenses, 2016−2020

(In millions of U.S. dollars)

Source: Financial and Operational Combined Uniform Single (FOCUS) Reports.

Table 2.11 FINRA-Registered Firms – Aggregate Financial Information, 2016–20201

(In millions of U.S. dollars, as of year-end)

| 2016 | 2017 | 2018 | 2019 | 2020 | |

| Total Revenues | $271,509.45 | $305,702.76 | $361,089.37 | $388,153.64 | $361,969.55 |

| Total Expenses | $246,194.06 | $268,632.72 | $318,309.31 | $344,210.51 | $284,757.13 |

| Pre-Tax Net Income | $25,315.39 | $37,070.05 | $42,780.06 | $43,943.13 | $77,212.41 |

Source: Financial and Operational Combined Uniform Single (FOCUS) Reports.

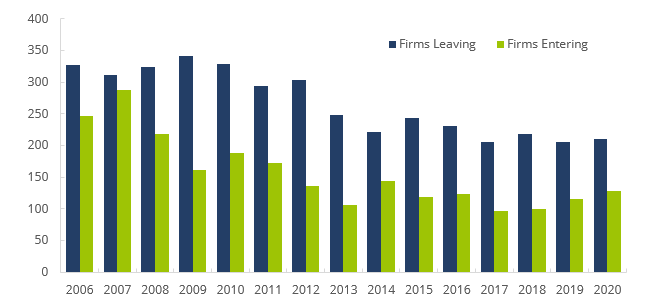

Figure 2.12 FINRA-Registered Firms – Leaving/Entering the Industry, 2006−2020

(Count as of year-end)

Source: Financial Industry Regulatory Authority.

Table 2.12 FINRA-Registered Firms – Leaving/Entering the Industry, 2006–2020

(Counts as of year-end)

| Year | Firms Leaving | Percent of Total | Firms Entering | Percent of Total | End of Year Total Firms |

| 2006 | -327 | -6% | 247 | 5% | 5,026 |

| 2007 | -312 | -6% | 288 | 6% | 5,002 |

| 2008 | -324 | -7% | 218 | 4% | 4,896 |

| 2009 | -341 | -7% | 162 | 3% | 4,717 |

| 2010 | -329 | -7% | 189 | 4% | 4,577 |

| 2011 | -294 | -7% | 172 | 4% | 4,455 |

| 2012 | -303 | -7% | 137 | 3% | 4,289 |

| 2013 | -249 | -6% | 106 | 3% | 4,146 |

| 2014 | -222 | -5% | 144 | 4% | 4,068 |

| 2015 | -244 | -6% | 119 | 3% | 3,943 |

| 2016 | -231 | -6% | 123 | 3% | 3,835 |

| 2017 | -205 | -5% | 96 | 3% | 3,726 |

| 2018 | -219 | -6% | 100 | 3% | 3,607 |

| 2019 | -206 | -6% | 116 | 3% | 3,517 |

| 2020 | -210 | -6% | 128 | 4% | 3,435 |

Source: Financial Industry Regulatory Authority.

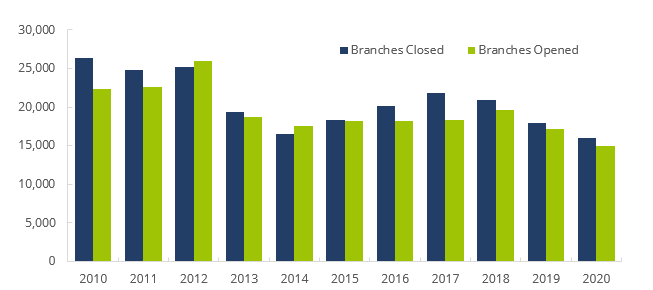

Figure 2.13 FINRA-Registered Firm Branch Offices – Opening/Closing, 2010−2020

(Count as of year-end)

Source: Financial Industry Regulatory Authority.

Table 2.13 FINRA-Registered Firm Branch Offices – Opening/Closing, 2010–2020

(Counts as of year-end)

| Year | Branches Closed | Percent of Total | Branches Opened | Percent of Total | End of Year Total Branches |

| 2010 | -26,324 | -16% | 22,336 | 14% | 162,711 |

| 2011 | -24,863 | -16% | 22,555 | 14% | 160,403 |

| 2012 | -25,193 | -16% | 25,939 | 16% | 161,149 |

| 2013 | -19,382 | -12% | 18,711 | 12% | 160,478 |

| 2014 | -16,554 | -10% | 17,522 | 11% | 161,272 |

| 2015 | -18,296 | -11% | 18,242 | 11% | 161,392 |

| 2016 | -20,103 | -13% | 18,175 | 11% | 159,464 |

| 2017 | -21,797 | -14% | 18,300 | 12% | 155,967 |

| 2018 | -20,875 | -13% | 19,569 | 13% | 154,661 |

| 2019 | -17,979 | -12% | 17,225 | 11% | 153,907 |

| 2020 | -15,987 | -10% | 14,941 | 10% | 152,861 |

Source: Financial Industry Regulatory Authority.

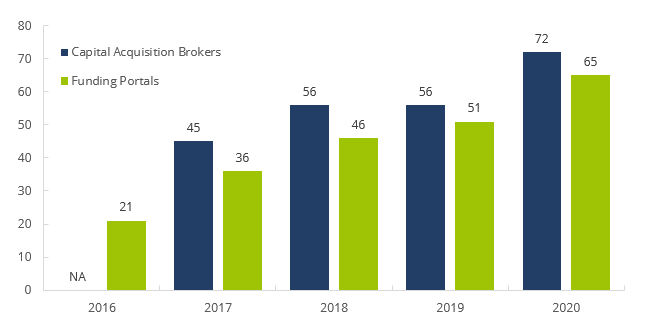

Figure 2.14 Spotlight: Capital Acquisitions and Funding Portals, 2016−20201

(Count as of year-end)

Source: Financial Industry Regulatory Authority.

1Capital Acquisition Brokers (CABs) engage in a limited range of activities, essentially advising companies and private equity funds on capital raising and corporate restructuring, and acting as a placement agent for sales of unregistered securities to institutional investors under limited conditions. The CAB rule took effect in 2017. Funding Portals (FPs) also engage in a limited range of activities: those prescribed under to JOBS Act and the SEC's Regulation Crowdfunding. The FP rule took effect in 2016.

FINRA Rule 2210 governs broker-dealers’ communications with the public, including communications with retail and institutional investors. The rule provides standards for the content, approval, recordkeeping and filing of communications with FINRA. FINRA’s Advertising Regulation Department reviews firms’ advertisements and other communications with the public to ensure they are fair, balanced, not misleading and comply with the standards of the SEC, MSRB, SIPC, and FINRA advertising rules. FINRA rules do not require all communications to be filed, and the figures presented below therefore represent only a segment of such communication.

Figure 2.15 Advertising Regulation Filing Volumes, 2016−2020

(Count as of year-end)

Source: Financial Industry Regulatory Authority.

Table 2.15 FINRA-Registered Firms — Most Common Marketing Methods Filed with FINRA, 2020

(Counts as of year-end)

| Marketing Methods | Total for Period 2019 |

| Web information public access | 25,087 |

| Fund specific information sheet(s) | 12,903 |

| Flyers & other hand delivered material | 4,847 |

| Brochures, pamphlets, & catalogs | 4,666 |

| Periodic & other performance reports | 3,188 |

| E-mail, IM, SMS or text messages | 3,038 |

| Mailed sales material | 2,695 |

| Seminar related communications | 1,925 |

| Audio/Video tapes, CDs & DVDs | 880 |

| Information released to the press | 724 |

| Web information password protected | 686 |

| Print ads, posters, & signs | 586 |

| Articles & 3rd party reprints | 502 |

| Software output & IA Tools | 463 |

| Research reports - equity & debt | 360 |

| Acct statement related communications | 226 |

| Broker Dealer use only material | 87 |

| TV ads & TV broadcasts | 76 |

| Radio ads & radio broadcasts | 65 |

| Business related stationery | 28 |

| Telemarketing & other phone scripts | 14 |

| Total | 63,046 |

Source: Financial Industry Regulatory Authority.

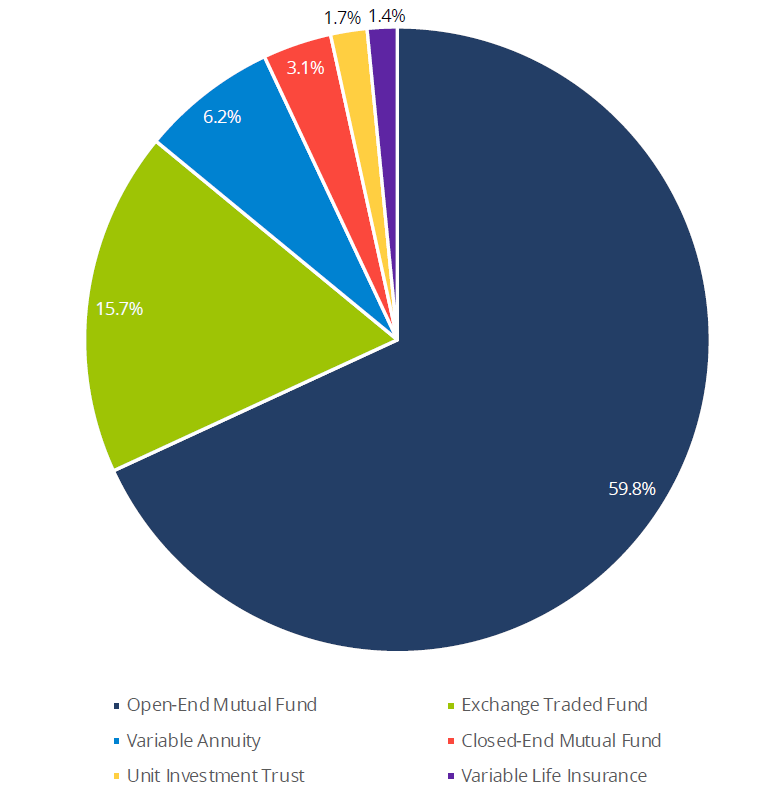

Figure 2.16 Advertising Regulation Filing Volumes – Investment Company Product, 2020

(Percentage of Total Filings)

Source: Financial Industry Regulatory Authority.

Table 2.16 Advertising Regulation Filing Volumes – Investment Company Product, 2020

| Investment Company Product Types | Percentage of Total Filings |

| Total Registered Investment Company Products | 87.8% |

| Total Non-Registered Investment Company Products | 12.2% |

Source: Financial Industry Regulatory Authority.

Table 2.17 Advertising Regulation Filing Volumes – Mandatory vs. Voluntary, 2016–2020

(Counts as of year-end)

| Filing Type | 2016 | 2017 | 2018 | 2019 | 2020 |

| Mandatory | 83,065 | 65,054 | 59,833 | 55,211 | 52,583 |

| Voluntary | 8,174 | 12,280 | 12,350 | 12,360 | 10,463 |

Source: Financial Industry Regulatory Authority.

On October 1, 2018, FINRA announced that it was moving toward an exam and risk monitoring program structure that is based on the business models of the firms FINRA oversees. FINRA has grouped firms according to the primary business(es) in which they are engaged. The following tables break down business segments by firm size.

Table 2.18 Small Firms – Business Segments as of December 20201

| Firm Grouping | Firm Sub-Grouping | Number of Firms |

| Capital Markets and Investment Banking Services | M&A and Investment Banking | 714 |

| Capital Markets and Investment Banking Services | Private Placements - Institutional Investors | 309 |

| Capital Markets and Investment Banking Services | Product Originator and Wholesaler | 202 |

| Capital Markets and Investment Banking Services | Niche/Other - CMIB | 109 |

| Capital Markets and Investment Banking Services | Public Finance | 47 |

| Clearing and Carrying | Chaperone - 15a-6 Firms | 80 |

| Clearing and Carrying | Securities Financing Book | 20 |

| Clearing and Carrying | Niche/Other - Clearing | 16 |

| Clearing and Carrying | Correspondent Clearing | 12 |

| Diversified | Small Diversified* | 76 |

| Diversified | Medium Diversified - Carrying/Clearing* | 12 |

| Diversified | Medium Diversified - Non-Carrying/Clearing* | 8 |

| Diversified | Large Diversified* | 1 |

| Retail | Retail Small* | 398 |

| Retail | Public Pooled Investment Vehicles and Variable Annuities | 223 |

| Retail | Retail Small - Independent Contractor* | 210 |

| Retail | Private Placements | 184 |

| Retail | Fintech | 40 |

| Retail | Retail with Carrying/Clearing Activities | 31 |

| Retail | Retail Mid-Size & Large - Independent Contractor* | 6 |

| Retail | Retail Mid-Size & Large* | 4 |

| Trading and Execution | Institutional Brokerage | 254 |

| Trading and Execution | Medium/Small Proprietary Trading and Market-Making* | 62 |

| Trading and Execution | Alternative Trading Systems (ATS's) and Electronic Communication Networks (ECN's) |

54 |

| Trading and Execution | Large Proprietary Trading and Market-Making* | 7 |

| Total | 3,079 |

Source: Financial Industry Regulatory Authority.

*The definition of firm size in FINRA’s By-Laws may differ from the Member Firm Business Segment definitions, which may consider total assets and/or total revenue in categorizing a firm. Small Firm = 1-150 registered representatives.

1Includes only FINRA-Registered firms as of year-end.

Table 2.19 Mid-Size Firms – Business Segments As of December 20201

| Firm Grouping | Firm Sub-Grouping | Number of Firms |

| Capital Markets and Investment Banking Services | Product Originator and Wholesaler | 46 |

| Capital Markets and Investment Banking Services | M&A and Investment Banking | 11 |

| Capital Markets and Investment Banking Services | Niche/Other - CMIB | 3 |

| Capital Markets and Investment Banking Services | Private Placements - Institutional Investors | 1 |

| Clearing and Carrying | Correspondent Clearing | 3 |

| Clearing and Carrying | Chaperone - 15a-6 Firms | 1 |

| Clearing and Carrying | Niche/Other - Clearing | 1 |

| Diversified | Medium Diversified - Carrying/Clearing | 13 |

| Diversified | Medium Diversified - Non-Carrying/Clearing | 9 |

| Diversified | Small Diversified* | 4 |

| Retail | Retail Mid-Size & Large - Independent Contractor* | 39 |

| Retail | Retail Mid-Size & Large* | 18 |

| Retail | Public Pooled Investment Vehicles and Variable Annuities | 12 |

| Retail | Retail Small - Independent Contractor* | 5 |

| Retail | Retail with Carrying/Clearing Activities | 2 |

| Retail | Private Placements | 2 |

| Retail | Retail Small* | 2 |

| Retail | Fintech | 1 |

| Trading and Execution | Institutional Brokerage | 12 |

| Trading and Execution | Large Proprietary Trading and Market-Making* | 5 |

| Trading and Execution | Medium/Small Proprietary Trading and Market-Making* | 1 |

| Total | 191 |

Source: Financial Industry Regulatory Authority.

*The definition of firm size in FINRA’s By-Laws may differ from the Member Firm Business Segment definitions, which may consider total assets and/or total revenue in categorizing a firm. Mid-Size Firm = 151-400 registered representatives.

1Includes only FINRA-registered firms as of year-end.

Table 2.20 Large Firms – Business Segments As of December 20201

| Firm Grouping | Firm Sub-Grouping | Number of Firms |

| Capital Markets and Investment Banking Services | Product Originator and Wholesaler | 19 |

| Capital Markets and Investment Banking Services | M&A and Investment Banking | 1 |

| Capital Markets and Investment Banking Services | Private Placements - Institutional Investors | 1 |

| Clearing and Carrying | Correspondent Clearing | 3 |

| Diversified | Medium Diversified - Carrying/Clearing* | 27 |

| Diversified | Large Diversified* | 13 |

| Diversified | Medium Diversified - Non-Carrying/Clearing* | 7 |

| Retail | Retail Mid-Size & Large - Independent Contractor* | 39 |

| Retail | Public Pooled Investment Vehicles and Variable Annuities | 31 |

| Retail | Retail Mid-Size & Large* | 15 |

| Retail | Retail with Carrying/Clearing Activities | 8 |

| Retail | Private Placements | 1 |

| Total | 165 |

Source: Financial Industry Regulatory Authority.

*The definition of firm size in FINRA’s By-Laws may differ from the Member Firm Business Segment definitions, which may consider total assets and/or total revenue in categorizing a firm. Large Firm = 500 or more registered representatives.

1Includes only FINRA-registered firms as of year-end.

Table 2.21 Number of Unique Corporate Financing Filings, 2016–20201,2,3

(Counts as of year-end)

| Total Number of Filings | 2016 | 2017 | 2018 | 2019 | 2020 |

| Total Public Offerings (FINRA Rule 5110) | 1,232 | 1,553 | 1,524 | 1,604 | 2,304 |

| Member Private Offerings (FINRA Rule 5122) | 148 | 128 | 99 | 60 | 51 |

| Private Placements of Securities (FINRA Rule 5123) | 2,442 | 2,451 | 2,372 | 2,449 | 2,300 |

Source: Financial Industry Regulatory Authority. Data as of March 2021.

*The total number of unique corporate financing filings (not including amendments to filings) received by the Corporate Financing Department.

1FINRA Rule 5110 requires all public offerings in which a member participates to be filed with FINRA for review, except as exempted from the filing requirement under paragraph (h).

2FINRA Rule 5122 requires firms that offer or sell retail private placements of their own securities or that of a control entity to file offering documents and information about the issuer, the offering and the selling firms before the documents are provided to investors, except as exempted from the filing requirements under section (C).

3FINRA Rule 5123 requires firms that sell non-proprietary, retail private placements to file with FINRA's Corporate Financing Department within 15 calendar days of the date of first sale, offering documents and information about the issuer, the offering and the selling firms, except as exempted from the filing requirements under section (B).