FINRA Requests Comment on Its Machine-Readable Rulebook Initiative

FINRA has extended the comment period to February 21, 2023.

*In response to requests for an extension, the comment period has been extended to February 21, 2023.

Summary

FINRA has begun developing a machine-readable rulebook to assist users to more readily analyze and search FINRA’s rules. As part of this initiative, FINRA is creating an embedded taxonomy (which is a method of classifying and categorizing a hierarchy of key terms and concepts) within certain FINRA rules, which can be more easily processed by a computer and, therefore, potentially less time-consuming and costly for a firm’s legal and compliance staff to review. Specifically, we applied, or “tagged,” the taxonomy terms that were developed to 40 FINRA rules, representing the most frequently viewed rules.1 FINRA has also created a prototype of a rulebook search tool—the FINRA Rulebook Search Tool™ (FIRST™). FINRA is launching the FIRST search feature through a user interface on the FINRA website. In addition, FINRA is offering access to the taxonomy terms that have been tagged to each of the 40 rules through an Application Programming Interface (API).

As described in greater detail below, we are soliciting comments on the machine-readable rulebook initiative, including the development of the taxonomy, the enhanced search features available through FIRST, the content available through the API, and any potential benefits or challenges associated with the overall user experience.

Questions regarding this Notice should be directed to:

- Haimera Workie, Vice President, Office of Financial Innovation, at (202) 728-8128 or email;

- Afshin Atabaki, Special Advisor and Associate General Counsel, Office of General Counsel, at (202) 728-8902 or email;

- Alex Khachaturian, Director, Office of Financial Innovation, at (202) 728-8275 or email;

- Nick Vitalo, Principal Counsel, Office of General Counsel, at (646) 315-8474 or email;

- Anadi Rastogi, Associate Product Manager, Technology, at email; or

- Dror Kenett, Senior Economist, Office of the Chief Economist, at (202) 728-8208 or email.

Action Requested

FINRA encourages all interested parties to comment on this Notice. Comments must be received by December 20, 2022 and submitted through one of the following methods:

- Emailing comments; or

- Mailing comments in hard copy to:

Jennifer Piorko Mitchell

Office of the Corporate Secretary

FINRA

1735 K Street, NW

Washington, DC 20006-1506

To help FINRA process comments more efficiently, persons should use only one method to comment on this Notice.

Important Notes: All comments received in response to this Notice will be made available to the public on the FINRA website. In general, FINRA will post comments as they are received.2

I. Development of the Machine-Readable Rulebook Prototype

FINRA’s machine-readable rulebook initiative is designed to enhance firms’ compliance efforts, reduce costs, and aid in risk management by making the rulebook more easily accessible and by facilitating efforts to automate compliance functions. These improvements can, in turn, support investor protection and market integrity.3

FINRA began exploring the potential benefits of a taxonomy-based machine-readable rulebook, in part, through the prior issuance of a special notice on financial technology innovation.4 More recently, we established an external working group—the Taxonomy Working Group—consisting of representatives in compliance roles from a range of FINRA member firms as well as other compliance experts, to assist in developing a machine-readable rulebook prototype.5

To help identify the FINRA rules for this initiative, we utilized data analytics software to determine the most-viewed rules on FINRA.org based on quantitative metrics such as unique page views.6 We also considered input from the Taxonomy Working Group regarding which rules may garner the most interest. Considering these factors, we selected 40 FINRA rules that account for approximately half of all page views of FINRA rules and then tagged the taxonomy terms we developed to each of these rules.

II. How Does a Taxonomy Work Within the Framework of a Rulebook?

The Taxonomy

The taxonomy that we have applied to the 40 FINRA rules is mapped out and made available in full through FIRST and the API system. This taxonomy is composed of a hierarchical classification of regulatory and securities industry terms.7 It consists of terms that are expressly referenced in the rules as well as broader regulatory concepts and industry terms associated with the rules. The taxonomy is divided into two main categories—summary topics and detailed topics. The summary topics include high-level, fundamental regulatory topics associated with the rules. These classifications allow users to identify a broader set of rules and select multiple topics that can further enhance the search process. The detailed topics are more comprehensive and particularized in scope. These are structured similar to topic indexing, allowing users to identify discrete topics associated with the rules.

The taxonomy is organized similar to a family tree: the first-level terms being the parents; the second-level terms being the children; and, where applicable, the third-level terms being the grandchildren.

Machine-Readability Through FIRST

The taxonomy applied to the FINRA rulebook is made available through FIRST using a browse functionality that allows users to explore the summary topics and detailed topics before selecting search terms. Users can expand and collapse the taxonomy as they browse. There is also a free text search function through which users can look for a specific term. The browse and free text search functions work together to enhance the overall user experience and improve research efforts. If users select a term through the browse functionality, the search results will list the rules to which we have tagged the selected term, within the subset of the 40 rules to which FIRST applies. Further, users can select multiple terms through the browse functionality to refine their search. For a guide on how to use the browse and free text search functions, please refer to the tutorial video available on our website.

Summary Topics

The summary topics consist of eight fundamental first-level terms:

- Account Information & Management (ACC);8

- Business Unit (BU);

- Customer Type (CT);

- Firm Type (FT);

- Numerical Reference (NR);

- Obligations & Duties (OD);

- Regulatory Process (RP); and

- Security Type (ST).

Under each of these terms, there are also second-level and, where applicable, third-level terms that allow users to further refine their searches. For example, the term Disclosures is listed under Obligations & Duties, and there are four additional terms listed under Disclosures, representing different types of disclosures: Customer or Investor; General Public; Other Member or Industry Participant; and Regulatory.

Users could also select multiple terms from across, or within, the first-level terms to enhance their search results. For instance, users could select the second-level terms Account Opening, Servicing or Termination (under Account Information & Management), Retail (under Customer Type) and Equity (under Security Type) to identify those rules to which we have applied all three of the terms.

Detailed Topics

The detailed topics consist of three main first-level terms:

- Defined Terms within the Rule or Rule Series (DT);

- Related Laws, Rules & Regulations (RL); and

- Terminology (TR).

Under each of these main terms, there are comprehensive sets of second-level and, in some cases, third-level terms. For example, various second-level terms are listed under the first-level term Terminology. These include: Communication & Media; Financial, Economic or Money; and Investment Plans or Programs, among other topics.

Machine-Readability Through an API

The taxonomy applied to the FINRA rulebook is made available through an API interface. An API is a software intermediary that allows two applications to communicate and interact with each other. APIs can facilitate how developers integrate new application components into their existing technology frameworks. Through the rulebook API on the FINRA API Platform, firms can ingest the rule content along with the taxonomy terms that we have applied to each of the 40 FINRA rules. This would enable member firms to develop an integration that links rule content and the taxonomy applied to the 40 rules to their internal compliance policies and procedures, where appropriate.

III. Securities Industry Use Cases and Applications

FIRST and the related API interface are intended to facilitate regulatory compliance and enhance the overall experience for users searching FINRA rules. However, it is important to note that the taxonomy is not intended to be a substitute for regulatory obligations, including the prescriptive rule requirements and the related guidance. Accordingly, we have included a prominent disclaimer on the search tool to inform users of this key distinction.9 In addition, because FIRST is currently a prototype in its early stages, it will evolve and be refined with user experience and feedback.

Based on discussions with member firms, FINRA envisions that firms will potentially leverage the efficiencies created by FIRST and the related API interface in several ways.

Technological Innovation and Content Curation

Member firms indicated that they typically search the FINRA rulebook—often through search engines—when prompted by certain events. Such events may include personnel changes, the launch of new products or business lines, training and education, revisions or updates to firm policies and procedures, risk assessments, audits, regulatory changes and responding to internal inquiries or regulatory requests. Firms also noted that the frequency of these events coupled with changes to financial regulations (including securities, advisory, banking and insurance regulations) dictate that they adopt technology to more efficiently understand and be able to comply with their regulatory obligations.

Through the implementation of FIRST and the associated API interface, we aim to enhance the search functionality of the FINRA rulebook and facilitate the ability of firms to automate their compliance functions. This is designed to assist with industry efforts already underway related to reshaping the way that regulatory information is organized and stored online in order to improve the efficiency by which that information is collected and processed. As member firms seek ways to save time and resources, there is likely to be demand for more metadata, structured content classification and access to APIs. Through these efforts, we are seeking to help lay the appropriate groundwork for member firms as they prepare for this future.

Rule Mapping and Regulatory Change Management

As noted, the FINRA API Platform provides a rulebook API that would allow member firms to receive rule content, along with the taxonomy terms associated with 40 FINRA rules and map this content to their internal policies and procedures. In addition, users may be able to access past versions of these rules to view changes over time. In the future, the FINRA API Platform may also provide an API interface that could be used to receive automatic updates to firms’ internal systems, regarding new or updated rule content. This feature could potentially assist firms in identifying, interpreting and complying with amendments and updates to FINRA rules, which would facilitate regulatory change management.

Resource Savings and Enhanced Compliance Capabilities

The improved information management that FIRST and the related API interface provide may help reduce the amount of resources that member firms need for compliance. Based on our engagement with industry participants, including member firms and other key stakeholders, we identified the following potential benefits:

- empowering firms to be proactive in their efforts to automate certain compliance functions;

- validating the quality of, and confidence in, compliance efforts;

- lowering barriers to launching new business lines and products;

- facilitating training efforts for compliance staff;

- providing senior staff more time to dedicate to other areas of a firm’s business; and

- enhancing cost savings and efficiency (e.g., fewer employee hours required, less expenses for consultants or legal counsel).

IV. Economic Analysis

FINRA conducted an analysis of the economic impacts associated with the development of a taxonomy-based machine-readable rulebook. The analysis incorporates results from a survey that was distributed to 109 member firms in the fourth quarter of 2019.10 The purpose of the survey was to gauge the potential benefits of such a rulebook and associated cost savings. There were 35 firms that responded to the survey, and the distribution of these firms according to firm size, measured by number of registered representatives, is provided in Table 1.11

| Firm Size Category (#RRs) | Survey Respondents | Industry | ||

|---|---|---|---|---|

| # Firms | Percent (A) | # Firms | Percent (B) | |

| Small-Micro (1-5) | 1 | 3% | 1,016 | 28% |

| Small-Small (6-10) | 2 | 6% | 680 | 19% |

| Small-Medium (11-49) | 10 | 31% | 1,177 | 33% |

| Small-Large (50-150) | 6 | 19% | 369 | 10% |

| Medium (150-499) | 3 | 9% | 192 | 5% |

| Large (500+) | 13 | 31% | 173 | 5% |

| Total | 35 | 100% | 3,607 | 100% |

Table 1: The distribution of the number of firms, and percentage of total, that responded to the survey by firm size, measured in number of registered representatives (“Survey Respondents”), and a breakdown of number of firms, and percentage of total, across all member firms (“Industry”).

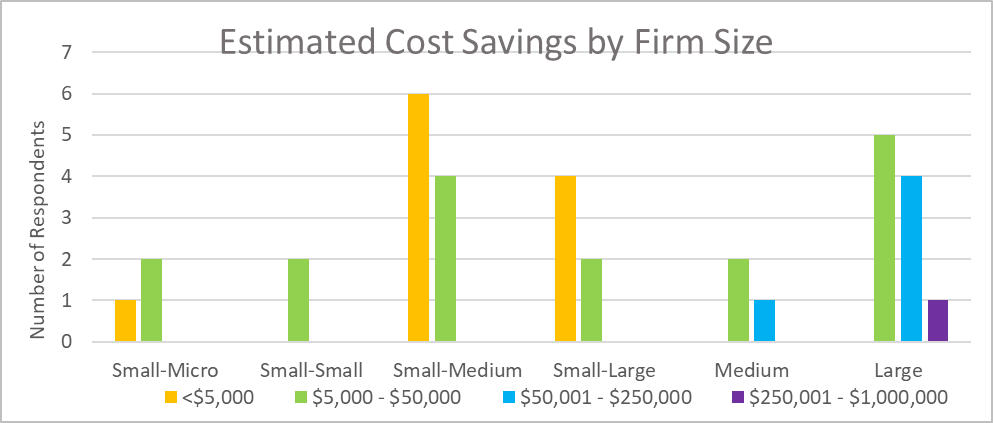

Most survey respondents anticipated accruing some net benefits from the availability of a taxonomy-based machine-readable rulebook (see Figure 1). No respondent anticipated a negative impact from any individual feature, and two respondents did not anticipate any potential savings. The survey responses did not mention any related costs to firms. The majority of respondents cited lower training costs, lower compliance risk and more senior staff time to focus on core business issues as the primary expected benefits. Additional potential benefits could arise from lower costs of third-party vendors, particularly outside counsel, that could leverage the taxonomy for the services they provide to their clients.

Figure 1: A breakdown of the respondents' estimation of potential cost saving resulting from the machine-readable rulebook, by firm size.

While intuitive and user-friendly technology-based tools exist to support compliance for firms, such tools may be more likely to be used by larger, or more well-resourced firms with access to integrated technologies. Industry representatives, as well as regulatory bodies around the world, have observed that compliance costs represent a significant portion of firm expenses.12 Moreover, findings have shown that new regulations may lead firms to invest further in technology resources (i.e., hardware, software and personnel). These investments are intended to achieve compliance, which, in turn, can result in fewer customer complaints, investor harm and employee misconduct.13 Such costs may disproportionately impact smaller firms and new market entrants.14

FINRA members of various sizes and business models stand to gain from FINRA delivering an integrated technological tool to facilitate compliance. Whether searching a taxonomy-based FINRA rulebook or automatically mapping to the FINRA API, these technological enhancements could improve access to the FINRA rulebook by making it easier for users to find potentially relevant rules. These could also help lower barriers to developing automated compliance tools and facilitate enhanced compliance by both small and large firms.

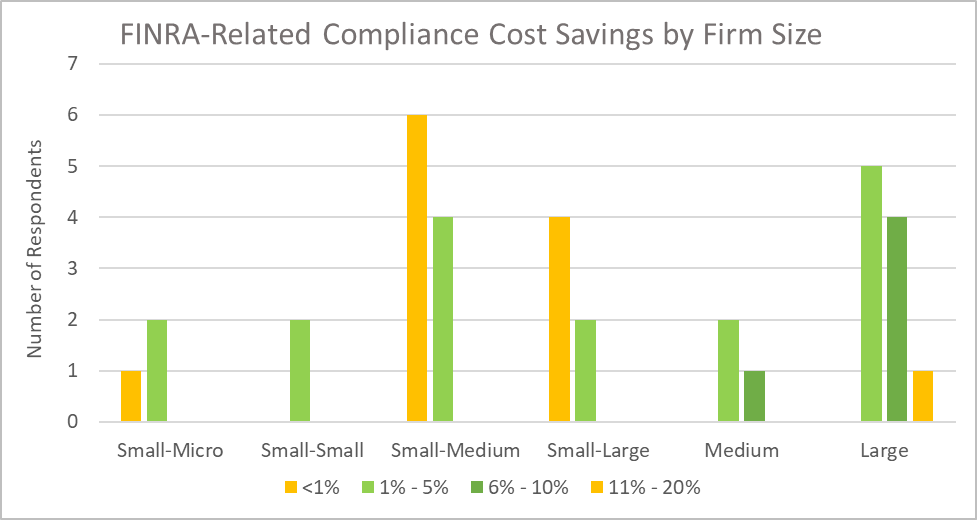

The estimates derived from the survey responses indicated savings for the industry as high as 8 percent of FINRA-related compliance costs (as an average across all responses, see Figure 2). The estimates appear to be optimistic given the survey caveats, such as the non-random sample and small sample, or the assumption that all direct costs to deploy, gain access and maintain the tool would be incurred by FINRA. Further, survey respondents may estimate higher benefits for something that they believe to be low or no cost to them. However, there could be some costs associated with the use of a taxonomy-based machine-readable rulebook. These costs could stem from any use related fees, such as with the API.

Figure 2: Respondents' estimate of cost savings as a percentage of their total FINRA-related compliance costs.

V. Request for Comments

By launching a prototype of a taxonomy-based machine-readable rulebook, FINRA is seeking feedback on the further development of the taxonomy terms, the use and design of the prototype search tool, the API system, and any potential benefits or challenges associated with the overall user experience. We recognize that we remain in the early stages of the product development cycle and that there are numerous paths forward that we can pursue with this initiative, including:

- making the prototype’s baseline taxonomy available to a collaborative, open-source community of firms and developers to create, eliminate or modify taxonomy terms to be applied to the rulebook and potentially to other relevant regulatory materials (e.g., published guidance);

- leveraging tools from RegTech vendors and external experts to continue work on the development of the taxonomy-based machine-readable rulebook, potentially including the adoption of automated tools to assist with identifying and applying taxonomy terms to additional rules and with maintaining the taxonomy on an ongoing basis;

- continuing to have FINRA staff develop the taxonomy-based machine-readable rulebook; or

- a combination of these efforts.

FINRA is seeking input on the potential paths forward outlined above as well as suggestions on other potential paths of action. In addition, FINRA is seeking substantive feedback on the taxonomy itself as well as the rule tags for the 40 rules. In this context, FINRA requests comments on the questions below.

A. Interactions with the FINRA Rulebook

- Will your interaction with the FINRA rulebook change now that FIRST, the prototype search tool, and the related API have been launched? If so, how will it change? Do you plan to use FIRST or the related API? If so, which are you more likely to use, or are you likely to use both?

- Are there other challenges that you currently encounter when searching for content on the FINRA rulebook that FIRST could help address?

- Are you more likely to use the summary topics or the detailed topics in FIRST to conduct your searches?

B. Uses of FIRST and FINRA’s API

- Who will be the primary beneficiaries of FIRST and the related API? Are there concrete use cases that market participants could use that have not been contemplated above?

- After reviewing this Special Notice and using FIRST and the related API, do you believe that your firm would use these tools to enhance its compliance procedures or practices? For example, how much do you believe that your firm would save annually in operational, compliance, legal or related costs? More broadly, what would be the tangible benefits to the industry as a whole?

- Does your firm currently rely on a taxonomy developed internally or by a third-party vendor? If so, how can existing taxonomies built by your firm most efficiently interact with a taxonomy developed by FINRA? Do you believe that the existence of a taxonomy developed by FINRA will make it more likely for your firm, and the industry as a whole, to incorporate new technologies into compliance functions?

C. Feedback on Taxonomy Terms, FIRST and the API

- Are the taxonomy terms organized in a clear and intuitive manner? Is the distinction between the summary topics and the detailed topics clear to users?

- Are there steps that you believe FINRA should take to explain more clearly to users how to use FIRST or the related API? For example, seminars, online tutorials, Q&As or virtual workshops?

- FIRST and the related API documentation provide a disclaimer to users that it is meant to serve as an informational tool, or an aid, to help identify potentially applicable rules, rather than to offer regulatory or compliance advice. Ultimately, it is incumbent upon firms to ensure that they remain compliant with their regulatory obligations. Further, use or reliance on the search tool is not a defense to a failure to comply with FINRA rules. Would additional information or context regarding these issues be useful?

- Are there specific aspects or functionalities of FIRST or the related API that you find particularly beneficial? Are there any that you find not to be beneficial?

- With respect to the browse functionality, do you find the selection process to be intuitive? As noted, this functionality allows users to expand or refine searches by selecting across, or within, the first-level terms. Do you find this feature to be useful for conducting searches?

- What is your view on the overall depth, quantity and quality of the taxonomy terms? Could it be improved and, if so, how?

- To what extent would you benefit from conducting a reverse search by selecting a rule tag term within a particular rule, which will then list other rules to which that term has been applied? How likely are you to discover additional relevant rules based on such searches?

- Where would you like to see FINRA prioritize its focus in the future: (a) facilitating the ability of others (including an open source community) to enhance the taxonomy and tag additional content; (b) applying taxonomy terms to additional rules; (c) applying taxonomy terms to other FINRA content (e.g., enforcement actions, regulatory notices and guidance); (d) revising the taxonomy terms that have been currently applied (and if so, how?); or (e) other steps?

- Does your firm currently use APIs? How likely is your firm to use the FINRA API now that it is being offered with the taxonomy terms for 40 rules as a way to help streamline the automation of compliance functions?

D. Future Development

- Are there any lessons that FINRA should account for based on experiences of other parties (regulators, industry participants, associations, etc.) that have considered the development of a taxonomy-based machine-readable rulebook? What types of collaborations or partnerships would be beneficial in this space?

- Are there readily available technological tools that FINRA can consider to automate the identification and application of taxonomy terms to its rulebook?

- FINRA is considering how to avoid potential risks associated with the proliferation of regulatory taxonomies and user interfaces that regulators, firms and technology vendors use. What are the risks and challenges in this area? Would some form of harmonization or standards for regulatory taxonomies be beneficial, and if so, how can FINRA best contribute to such outcomes?

- Do you support making the taxonomy available through an open-source manner for public-private collaboration for further development of a taxonomy-based machine-readable rulebook? How could this initiative, on a going forward basis, benefit from open-source collaboration? Who could FINRA best collaborate with and how?

- Alternatively, should FINRA devote additional resources to further building out this search tool and keep development largely internal?

- What other forms of future collaboration from FINRA would best serve the objectives of this initiative? What role should vendors and member firms play in the adoption, development and ongoing maintenance of a taxonomy-based machine-readable rulebook?

Endnotes

1The rules tagged as part of the machine-readable rulebook initiative consist of the following 40 FINRA rules: 1210, 1220, 1230, 1240, 2010, 2040, 2090, 2111, 2122, 2210, 2231, 2241, 2360, 3110, 3120, 3130, 3210, 3220, 3240, 3270, 3280, 3310, 4140, 4160, 4210, 4311, 4370, 4511, 4512, 4513, 4530, 4570, 5110, 5121, 5123, 5130, 5131, 5310, 8210 and 8312.

2Parties should submit in their comments only personally identifiable information, such as phone numbers and addresses, that they wish to make available publicly. FINRA, however, reserves the right to redact or edit personally identifiable information from comment submissions. FINRA also reserves the right to redact, remove or decline to post comments that are inappropriate for publication, such as vulgar, abusive or potentially fraudulent comment letters.

3See Organization for Economic Cooperation and Development (OECD), OECD Business and Finance Outlook 2021: AI in Business and Finance: The Use of SupTech to Enhance Market Supervision and Integrity.

5These include, among others, FINRA advisory committees, the Securities Industry and Financial Markets Association (SIFMA), the Global Financial Innovation Network (GFIN) and the FinTech Open Source Foundation (FINOS) Regulatory Taxonomy Special Interest Group.

6Using Google Analytics, we were able to identify, in aggregate, trends and patterns on how visitors to FINRA.org engaged with the FINRA rulebook, including which rules were most visited.

7A taxonomy is a mechanism used for categorizing information and structuring it in a way that is intuitive for users. Information that is organized, managed and indexed through a taxonomy allows users to track down specific content by starting with a broad topic and then narrowing down to more specific topics through sub-categories and combinations of multiple terms.

8The first-level terms include parenthetical abbreviations.

9The disclaimer states: The FINRA Rulebook Search Tool™ (FIRST™) is for informational purposes only and does not provide regulatory or compliance advice. You should always review the relevant rule text and the related guidance to understand your regulatory obligations. Usage or reliance on this tool is not a defense to a failure to comply with the FINRA rules.

10A major caveat of the survey and the information collected through it is the time period. The survey was designed and distributed in the second half of 2019. FINRA understands that this reflects a pre COVID-19 pandemic world, in terms of the industry and its policies and processes as well as the regulatory environment. The pandemic had a significant impact both on the industry and the regulatory community, with the transition to remote work being one major change. Thus, while the data was collected in the pre-pandemic world, FINRA believes the results might be a lower bound and under-representation of the potential impacts of a taxonomy-based machine-readable rulebook.

11See FINRA 2022 Industry Snapshot (providing a definition of firm size).

12See, e.g., Susannah Hammond, Cost of Compliance Report 2022: Officers Face Competing Priorities & Future Planning, Thomson Reuters (July 6, 2022).

14See Raphael Auer, Embedded Supervision: How to Build Regulation Into Decentralised Finance, Bank for International Settlements (BIS), Working Paper No. 811 (Sept. 16, 2019).

| Date | Commenter |

|---|---|

| Randy Repka Comment On Special Notice – 10/21/22 | |

| Uncharted Software Comment On Special Notice - 10/21/22 | |

| Dhruv Bhardwaj Comment On Special Notice – 10/21/22 | |

| ING Bank Comment On Special Notice - 10/21/22 | |

| Corlytics Comment On Special Notice - 10/21/22 | |

| Deborah Young Comment On Special Notice – 10/21/22 | |

| Chris Caldwell Comment On Special Notice – 10/21/22 | |

| Jane Garvronsky Comment On Special Notice - 10/21/22 | |

| 1WordFlow and Regulation City Comment On Special Notice - 10/21/22 | |

| RegGenome Comment On Special Notice - 10/21/22 | |

| Cambridge Judge Business School at the University of Cambridge Comment On Special Notice - 10/21/22 | |

| Clausematch Comment On Special Notice - 10/21/22 | |

| Braithwate Comment On Special Notice - 10/21/22 | |

| Vermeg Comment On Special Notice - 10/21/22 | |

| Synechron Comment On Special Notice - 10/21/22 | |

| Giuseppe Scalia Comment On Special Notice - 10/21/22 | |

| University of Pittsburgh Securities Arbitration Clinic Comment On Special Notice - 10/21/22 | |

| Xalgorithms Foundation Comment On Special Notice - 10/21/22 | |

| Sarah Sinclair Comment On Special Notice - 10/21/22 |