FINRA Provides Update on Member Firms’ Crypto Asset Activities

Background

As part of FINRA’s mission to protect investors and promote market integrity, we are focused on addressing the regulatory challenges presented by our member firms’ crypto asset activities. Crypto assets—also known as digital assets—are assets that are issued or transferred using distributed ledger or blockchain technology. They include, but are not limited to, so-called virtual currencies, coins, and tokens. A particular crypto asset may or may not meet the definition of a “security” under the federal securities laws.

FINRA’s Focus on Crypto Assets

The Crypto Hub (the Hub) is an enterprise-wide initiative to enable FINRA to fulfill its regulatory mission with respect to crypto asset activities of member firms and associated persons. The Hub includes representatives from nearly every FINRA department working as a nerve center to manage FINRA’s crypto asset-related regulatory work.

Crypto Asset Investigations (CAI) within Member Supervision is a team of subject matter experts who conduct investigations related to crypto assets. CAI also provides crypto asset-related guidance and training to staff across FINRA’s regulatory operations and shares threat intelligence and effective practices with the industry to combat crypto asset-related threats facing investors, member firms and the securities markets.

The Crypto Asset Surveillance Team (CAST) within FINRA’s Market Regulation and Transparency Services Department (MRTS) is a team of subject matter experts who lead FINRA’s market surveillance efforts related to crypto assets and other crypto asset-related products transacted by FINRA member firms.

The Blockchain Lab (the Lab) within FINRA’s Office of Regulatory Economics and Market Analysis (REMA) is a team of subject matter experts that lead FINRA’s efforts to build or source blockchain-related regulatory initiatives and technology solutions to help facilitate oversight of crypto asset and blockchain related activities conducted by member firms and associated persons.

While many kinds of market participants may engage in crypto asset activities, FINRA only regulates its member firms and their associated persons. With respect to activities involving crypto assets that are securities, member firms and associated persons must comply with the applicable federal securities laws and FINRA rules. In addition, certain FINRA rules apply to activities of member firms and their associated persons with respect to their activities involving assets other than securities, including crypto assets that are not securities. Accordingly, since 2018, FINRA has asked member firms to promptly notify their Risk Monitoring Analyst (RMA) if the member firm, their associated persons or affiliates engage, or plan to engage, in activities related to crypto assets.1 In 2023, FINRA supplemented these engagement efforts by asking nearly 600 member firms to complete a questionnaire (the crypto asset questionnaire).

This update includes themes identified by FINRA related to member firms and their affiliates’ crypto asset activities based on a review of information provided by member firms in response to the 2018, 2019 and 2021 Notices2 and the 2023 crypto asset questionnaire, as well as information collected by FINRA through its ongoing regulatory operations. This represents FINRA’s understanding at the time of this publication based on information currently available to FINRA through these efforts. Many of the touch points identified are indirect, in that they relate to activity being conducted by associated persons, affiliates or parent companies, rather than directly by member firms. While FINRA has jurisdiction over the activity and conduct of our member firms and their associated persons, it does not have jurisdiction over their affiliates, parent companies or other unaffiliated third parties that are not otherwise member firms.

As a reminder, this update does not create new legal or regulatory requirements or new interpretations of existing requirements, nor does it relieve firms of any existing obligations under federal securities laws and regulations. Member firms may consider the information in this update in developing new, or modifying existing, policies and procedures to achieve compliance with relevant regulatory obligations based on the member firm’s size, business model, or practices.

Ongoing Member Firm Engagement and the Crypto Asset Questionnaire

The crypto asset market is large and has grown rapidly over the last decade, with significant fluctuations. This growth has included an increase in product offerings, retail investor participation (especially among younger investors) and related activities by member firms and associated persons.

In Regulatory Notice 21-25 (FINRA Continues to Encourage Firms to Notify FINRA if They Engage in Activities Related to Digital Assets), as well as prior notices,3 FINRA asked member firms to keep FINRA informed if member firms, or their associated persons, parent companies or affiliates, engaged in, or intended to engage in, activities related to crypto assets. In addition, FINRA’s RMAs routinely have discussions with member firms regarding updates to the member firm’s business activities, including new and evolving crypto asset activities, as part of the normal course of FINRA’s member firm engagement. FINRA welcomes ongoing dialogue with member firms and encourages firms to continue engaging with RMAs about their crypto asset activities, the crypto asset industry, and emerging regulatory challenges.

FINRA has continued to develop a detailed understanding of member firms’ crypto asset activities to inform and enhance FINRA’s regulatory operations with respect to these crypto asset activities. FINRA also sought to understand the ways in which member firms were connected to the broader crypto asset industry to enable FINRA to quickly assess the impact of future crypto asset-related events on member firms.

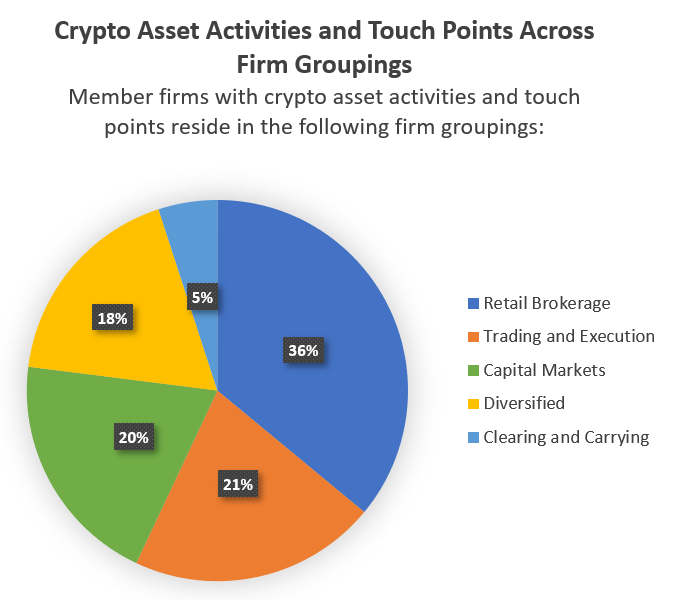

To that end, FINRA selected nearly 600 member firms to receive the crypto asset questionnaire. Member firms were selected based on FINRA’s knowledge of the member firms and internal data which indicated that the member firm—or their associated persons, affiliates, or parent companies—may be engaged in crypto asset activities or have a touch point to a crypto asset business. The goals of the crypto asset questionnaire included:

- To capture information related to member firms’ crypto asset activities and touch points in a consistent and centralized manner; and

- To enable member firms to update and validate information previously provided in response to these Notices.

Initial Themes

FINRA’s engagement with member firms has provided helpful insights and enabled FINRA to identify trends related to the crypto asset business activities FINRA member firms are engaged in and their touch points to the broader crypto asset industry.

Overall, through review of the responses to the crypto asset questionnaire and other information collected by FINRA’s regulatory operations, FINRA has identified around 390 member firms that fall into one or more of the following categories:

- The member firm, or its parent company or affiliate, has an active crypto asset business activity.

- The member firm, or its parent company or affiliate, plan to initiate a crypto asset business activity in the future.

- The member firm, or its parent company or affiliate, is under direct or indirect common ownership with a crypto asset “exchange” or intermediary.

- The member firm, or its parent company or affiliate, has a partnership or arrangement with a crypto asset “exchange” or intermediary.

- The member firm employs one or more associated persons with a disclosed outside business activity (OBA) or private securities transaction (PST) that involves crypto assets.

FINRA identified a number of themes related to the crypto asset business activities being conducted by member firms and associated persons, as well as the affiliations, partnerships and other arrangements between member firms and crypto asset-related companies. Overall, the themes identified include:

- Crypto Asset Activities of Member Firms – FINRA identified member firms currently engaged in one or more types of crypto asset activity. Overall, the types of crypto asset activities being conducted by member firms include:

- Private Placements – Some member firms have acted as placement agents, wholesalers, or distributors of private placements of crypto assets or companies involved in crypto asset activities.

- Alternative Trading Systems (ATSs) – Some member firms have been approved to operate as ATSs to facilitate trading in crypto asset securities pursuant to the July 2019 Joint Staff Statement on Broker-Dealer Custody of Digital Asset Securities or the SEC’s September 2020 No Action Letter, ATS Role in the Settlement of Digital Asset Security Trades.

- Custody – Thus far, one member firm has been approved to custody crypto asset securities pursuant to the SEC’s December 2020 statement, Custody of Digital Asset Securities by Special Purpose Broker-Dealers (SPBD Statement).

- Facilitation of Customer Crypto Asset Transactions Through Affiliates or Third Parties – Some member firms have established relationships with affiliates or third parties to provide their customers with access to crypto assets trading and custody services. Some member firms in this category require customers to maintain accounts at the member firm to have access to these crypto asset-related services.

- Blockchain and Distributed Ledger Technology Initiatives – Some member firms have engaged in distributed ledger technology initiatives or test cases to enable transactions executed or executed and settled on permissioned blockchains.

- Other Crypto Asset-Related Activities – Some member firms have engaged in other crypto asset activities, such as introducing institutional customers to third party crypto asset custodians and crypto asset-related investment banking and advisory services for companies engaged in crypto asset-related activities.

- Crypto Asset-Related OBAs and PSTs – FINRA identified member firms with individuals that have a disclosed OBA or PST that involves crypto assets. Examples of OBAs and PSTs identified include, but are not limited to, proprietary trading of crypto assets, operating investment funds that invest in crypto assets, selling crypto asset-related private placements or other offerings, and participating in crypto mining operations.

- Other Member Firm Crypto Asset Touch Points – FINRA identified member firms with parent companies or affiliates that engage in a variety of other crypto asset-related activities. These activities include operating a crypto asset trading platform or intermediary, proprietary trading or market making, custodial services, investment banking and advisory services for crypto asset-related entities, advising or managing portfolios that include holdings of crypto assets or crypto asset-related companies and engaging in distributed ledger technology initiatives. FINRA also identified member firms, their affiliates, or parent companies with strategic partnerships or arrangements with companies engaged in crypto asset-related activities:

- Member Firm Level – At the member firm level, these included arrangements established to provide the member firm’s customers with access to crypto asset trading and custodial services, create training and educational materials, facilitate crypto asset liquidity, or utilize distributed ledger technology for certain types of transactions (e.g., repurchase and reverse repurchase transactions).

- Parent Company and Affiliate Level – At the parent company or affiliate level, these included strategic investments and exploratory relationships, referral arrangements, the use of distributed ledger technology platforms, providing traditional banking services to crypto asset trading and lending platforms, maintaining proprietary relationships for the purposes of lending and borrowing crypto assets to facilitate proprietary trading, and other business arrangements related to crypto asset-related activities.

FINRA Oversight of Member Firms’ Crypto Asset-related Activities

FINRA continues to evolve our regulatory programs to better oversee member firms and associated persons engaged in crypto asset activities for compliance with applicable securities laws and regulations and FINRA rules. FINRA has identified member firms engaging in crypto asset-related activities that have encountered challenges with various FINRA rules. While not exhaustive, the following is a list of certain potential violations involving crypto asset-related activities that we have observed in our regulatory programs to date:

- In our reviews of crypto asset-related communications, FINRA has identified potential violations of FINRA Rule 2210 (Communications with the Public), including, for example, misrepresentations of the extent to which the protections of the federal securities laws or FINRA rules applied to crypto asset-related activities. Initial themes related to member firms’ crypto asset-related communications were addressed in our recent update, FINRA Provides Update on Targeted Exam: Crypto Asset Communications (January 2024).

- FINRA has identified potential violations of FINRA Rule 3110 (Supervision), including with respect to failures to complete reasonable due diligence on crypto asset private placements and engage in effective supervision designed to monitor crypto asset activities.

- FINRA has issued disciplinary actions finding violations of FINRA Rules 3270 (Outside Business Activities of Registered Persons), 3280 (Private Securities Transactions of an Associated Person), and 3110 for failures related to the disclosure of crypto asset OBAs and the approval and supervision of PSTs.

- FINRA has identified potential violations of FINRA Rule 3310 (Anti-Money Laundering Compliance Program) related to the failure by member firms to establish AML programs reasonably designed to detect and cause the reporting of suspicious transactions in crypto assets conducted or attempted by, at or through the broker-dealer.

- FINRA has issued disciplinary actions finding violations of FINRA Rule 2010 (Standards of Commercial Honor and Principles of Trade) related to: (i) a member firm and associated person negligently causing the dissemination of promotional materials that the member firm or associated person should have known contained material misstatements and omitting material facts related to the member firm’s crypto asset business; (ii) an associated person facilitating money movements and crypto asset-related activities, even though the associated person believed funds were the proceeds of illegal activities and part of money laundering activities; and (iii) associated persons providing false responses relating to crypto asset outside business activities or private securities transactions on a member firm’s annual compliance questionnaire.

- FINRA has noted in disciplinary action findings violations of FINRA Rule 8210 (Provision of Information and Testimony and Inspection and Copying of Books) related to associated persons failing to provide records on crypto asset-related outside business activities and private securities transactions, failing to provide such records in a timely manner, or failing to appear for testimony related to crypto asset-related OBAs and PSTs.

- On the market surveillance front, FINRA has identified potential situations where individuals are seeking to take advantage of investor interest in crypto assets and blockchain technology to perpetrate pump-and-dump schemes and other forms of market abuse in the equity markets. FINRA has also noted potential market abuse involving crypto asset securities traded on registered ATSs.

As with all business activities, member firms seeking to engage in crypto asset-related activities should proactively identify and address the relevant regulatory and compliance challenges and risks of such activities. This may include, for example, reviewing and evaluating their supervisory programs and controls, and compliance policies and procedures, in areas such as cybersecurity, AML compliance, communications with the public, manipulative trading, performing due diligence on crypto asset private placements and their associated persons' involvement in crypto asset-related OBAs and PSTs. As noted above, this list is not exhaustive, and member firms are responsible for ensuring that their crypto asset-related activities comply with all applicable federal securities laws and regulations, as well as FINRA rules.

Appendix – Additional Resources

- SEC Guidance

- Custody of Digital Asset Securities by Special Purpose Broker-Dealers (December 23, 2020).

- ATS Role in the Settlement of Digital Asset Security Trades (September 25, 2020).

- Joint Staff Statement on Broker-Dealer Custody of Digital Asset Securities (July 8, 2019).

- FINRA Guidance

- Regulatory Notice 21-25 (FINRA Continues to Encourage Firms to Notify FINRA if They Engage in Activities Related to Digital Assets)

- Regulatory Notice 20-23 (FINRA Encourages Firms to Notify FINRA if They Engage in Activities Related to Digital Assets)

- Regulatory Notice 19-24 (FINRA Encourages Firms to Notify FINRA if They Engage in Activities Related to Digital Assets)

- Regulatory Notice 18-20 (FINRA Encourages Firms to Notify FINRA if They Engage in Activities Related to Digital Assets)

- FINRA Publications

- 2024 Regulatory Oversight Report – Crypto Asset Developments

- 2024 Regulatory Oversight Report – Outside Business Activities and Private Securities Transactions

- Member Application Program (MAP) Compliance Resources – Guidance for Digital Asset Applications

- FINRA Resources

- An Inside Look Into FINRA’s Crypto Asset Work (August 3, 2023)

- FINRA-NFA Crypto Assets Summit (May 10, 2023)

- 2023 FINRA Annual Conference – Crypto Asset Developments

- An Introduction to FINRA’s Crypto Asset Work and the Crypto Hub (August 8, 2023)

- FINRA’s Blockchain Lab: Regulation and Innovation for the Future (September 19, 2023)

- A Closer Look at Crypto: The Crucial Role of FINRA’s CAI Team (September 5, 2023)

- FINRA Podcast – Membership Application Program: Reviewing and Approving Digital Asset Firms

- Crypto Assets Key Topic Page

- Industry Risks and Threats – Resources for Member Firms

- FINRA Provides Update on Targeted Exam: Crypto Asset Communications (January 2024).

Endnotes

1 Regulatory Notices 18-20 (FINRA Encourages Firms to Notify FINRA if They Engage in Activities Related to Digital Assets); 19-24 (FINRA Encourages Firms to Notify FINRA if They Engage in Activities Related to Digital Assets); 20-23 (FINRA Encourages Firms to Notify FINRA if They Engage in Activities Related to Digital Assets); and 21-25 (FINRA Continues to Encourage Firms to Notify FINRA if They Engage in Activities Related to Digital Assets).

2 See id.

3 See supra note. 1.