Board Elects New Chair and Discusses Outside Business Activities, TRACE Reporting Timeframes, Technology Initiatives and 2024 Fine Monies

WASHINGTON—FINRA’s Board of Governors met on February 25-26. The agenda included electing a new Board Chair, as well as discussions on FINRA’s proposed Outside Business Activities rule, TRACE reporting timeframes, ongoing technology initiatives, and the proposed allocation of FINRA’s 2024 fine monies.

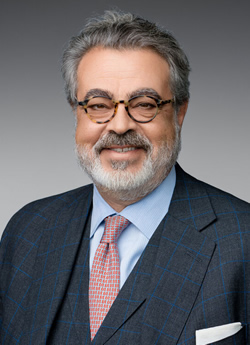

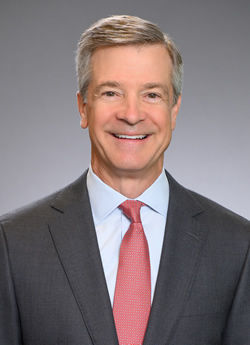

Eric Noll |  Scott A. Curtis |

Eric Noll is stepping down as Chair to pursue an opportunity that would conflict with his role as a Public Governor. To succeed him, the Board elected Scott A. Curtis, who has served as a Governor and Large Firm Representative since 2023.

“It has been an honor and privilege to chair the FINRA Board of Governors,” said Noll, who had served as Chair since 2022. “I am extremely proud of the work the Board has done in furthering FINRA’s mission of protecting investors and ensuring market integrity.”

“We are incredibly grateful to Eric for his commitment to FINRA and our mission. His leadership and guidance have been vital as FINRA has continued to adapt and improve our policies and programs in pace with our dynamic capital markets and industry,” said FINRA CEO Robert Cook. “I look forward to working with Scott, whose breadth of financial knowledge and leadership experience will be invaluable in his new role.”

Curtis has been Chief Operating Officer of Raymond James Financial since 2024. Prior to that, he had been President of the firm’s Private Client Group since 2018, leading the firm’s domestic wealth management business. He has served the firm in senior leadership roles since 2003. Curtis earned his M.B.A. from the Ross School of Business at the University of Michigan and received a B.A. in Economics and English from Denison University.

“I am excited to continue building upon the work Eric led in providing strategic guidance for FINRA’s essential role of protecting investors and safeguarding the integrity of the capital markets,” said Curtis. “I look forward to working with the other Governors and FINRA’s leadership team in this new capacity.”

Additional Board Actions and Updates

The Board appointed two new members to the National Adjudicatory Council, a committee that reviews initial decisions rendered in FINRA disciplinary and membership proceedings: Richard Kuhlman, Senior Vice President and Chief Legal Officer, Cambridge Investment Research, Inc. (Large Firm NAC Member); and Trinity Lee, President and Executive Director, Heim, Young & Associates, Inc. (Small Firm NAC member). Their engagement will provide essential support to FINRA’s regulatory processes; we welcome the new members and look forward to their input.

As is customary for the first meeting of the year, the Board approved the allocation of prior-year fine monies to various capital initiatives in accordance with FINRA’s Financial Guiding Principles. Fines are collected and accounted for separately from monies designated in FINRA’s operating budget, and their use is subject to special governance procedures, use restrictions and transparency requirements. As part of FINRA’s financial transparency, the details about the allocations will be released in the upcoming Report on the Use of 2024 Fine Monies.

The Board received a briefing on the examinations and investigations programs, including an update on an initiative to modernize the technology used by FINRA’s examination staff.

Consistent with FINRA’s commitment to continuously improving its regulatory standards, the Board considered rule proposals to modernize requirements and eliminate unnecessary burdens while maintaining investor protection and market integrity:

- The Board approved the publication of a Regulatory Notice soliciting comment on a revised proposed Rule 3290 (Outside Activities Requirements) to replace FINRA Rules 3270 (Outside Business Activities of Registered Persons) and 3280 (Private Securities Transactions of an Associated Person). The revised proposal would replace two rules with a single rule that provides clarity and reduces unnecessary compliance burdens for member firms in reviewing outside activities of their associated persons.

- The Board also considered updates to the TRACE reporting timeframes, to reduce undue operational burdens and complexity consistent with Cook’s recent blog.

More information regarding the Board’s operations, including the membership and responsibilities of its committees, is available here.

About FINRA

FINRA is a not-for-profit organization dedicated to investor protection and market integrity. FINRA regulates one critical part of the securities industry—member brokerage firms doing business in the U.S. FINRA, overseen by the SEC, writes rules, examines for and enforces compliance with FINRA rules and federal securities laws, registers broker-dealer personnel and offers them education and training, and informs the investing public. In addition, FINRA provides surveillance and other regulatory services for equities and options markets, as well as trade reporting and other industry utilities. FINRA also administers a dispute resolution forum for investors and brokerage firms and their registered employees. For more information, visit www.finra.org.