Compare Funds With FINRA’s Fund Analyzer

Comparing different products before you buy is a smart shopping strategy. But evaluating features and pricing isn’t just for groceries, clothing and appliances. Comparison shopping for financial products such as mutual funds and exchange-traded funds (ETFs) is an investment of time that could pay big dividends.

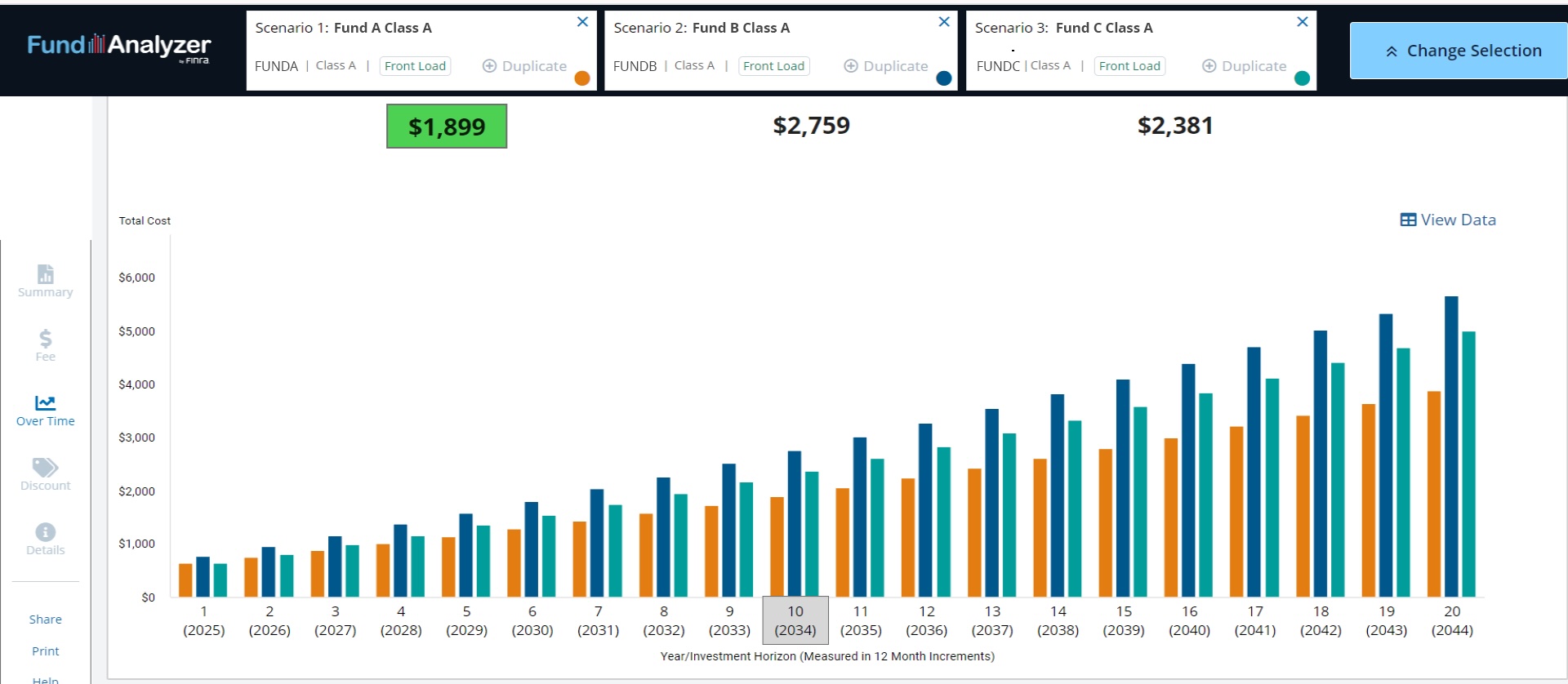

FINRA's Fund Analyzer tool can help you make informed decisions about your investments by demonstrating the impact of fees and potential discounts on mutual funds, ETFs, exchange-traded notes and money market funds.

While you can’t control future fund performance, you can maximize your investment by selecting funds that provide the best value for your needs. The Fund Analyzer helps you find lower cost funds, which could save you a significant amount of money over your investing horizon. Even a seemingly small difference in fees can eventually add up to thousands of dollars.

The Fund Analyzer allows you to sort and compare mutual funds, ETFs and money market funds and run calculations for different investment scenarios. The tool also lets you calculate how a fund's fees, expenses and discounts impact its value over time.

The Fund Analyzer is designed to help investors evaluate funds that might best meet their needs while providing the greatest value. Its advanced features let you compare the estimated impact on a fund’s value of typical investment behaviors and scenarios such as periodic contributions and withdrawals, trade frequency and different future rates of return. The Fund Analyzer also illustrates the impact that wrap accounts or flat fees can have on overall costs as well as future account value when holding mutual funds.

To use the Fund Analyzer, simply select up to three funds to compare, the amount of money you plan to invest and how long you expect to hold the fund. The Fund Analyzer reveals how fees and expenses will influence the value of the fund over time. Remember: The tool’s projections of future performance are based on the rate of return you select and aren't a depiction of actual investment returns.

Other Fund Analyzer features include:

- a display that helps investors visualize how a fund's annual operating expenses compare to its product and share class peers;

- the ability to assess the impact of potential breakpoint discounts or waivers that may apply;

- analysis of new and emerging share classes with variable and firm-specific fee scenarios; and

- data on a fund's past performance, including the process behind Morningstar ratings and access to important fund documentation.

Learn more about using the Fund Analyzer, including its more advanced features and data analysis functions.