Short Interest Reporting Instructions

Pursuant to FINRA Rule 4560, member firms are required to report total short positions in all customer and proprietary firm accounts in all equity securities to FINRA on a bi-monthly basis. These filings are made online using the Short Interest reporting system accessible via FINRA Gateway at gateway.finra.org.

All firms that report short interest to FINRA are responsible for maintaining current and previous cycle short interest reports pursuant to SEC recordkeeping requirements. The web-based system is the only method for reporting the firm’s proprietary and customer short positions. If your firm notes any discrepancies in the filing of its short interest report or has any reporting questions, please contact Jocelyn Mello-Gibbon at (240) 386-5091 or Lauren Zito at (240) 386-5432. Please direct questions about entitlement or access to the system to your firm’s account administrator. If you do not know who your account administrator is, please contact the FINRA Support Center at (301) 590-6500.

General Instructions

Member firms that have short positions in OTC equity securities and in securities listed on a national securities exchange, such as NASDAQ, NYSE, NYSE American, NYSE Arca, and/or Cboe BZX, must file a Short Position Report with FINRA via the Web-based system. The application will accept filings for the current reporting period as of 8 a.m. Eastern Time (ET) on the business day following the designated settlement date.

Each member firm must file a Short Position Report with FINRA for each reporting period to report total short positions for all customer and proprietary accounts maintained at the firm.

The Reporting Period: Firms must report their mid-month short positions as of the close of business on the settlement date of the 15th of each month or, where the 15th is a non settlement date, on the preceding settlement date. Firms must report their end-of-month short positions as of the close of business on the last business day of the month on which transactions settle.

The Filing Date: Filings must be received by FINRA by 6:00 p.m., ET, on the designated due date, which is the second business day after the designated settlement date.

Short Interest Reporting: Short positions for all firm accounts, including those for the firm’s partners/officers, employees and customers must be reported. The report should list, in alphabetical order, the relevant exchange/market code, issue symbol, security name, and number of common shares, preferred shares, warrants, units or ADRs short for the current reporting period as of the designated settlement date. Firms should report only whole numbers of shares, and not decimals or fractional shares.

Firms are required to designate the appropriate exchange or market code, as of the designated settlement date, for each issue symbol and short position reported.1 Firms must append the appropriate exchange or market code to the corresponding issue symbol that represents the primary exchange or market on which the security is listed in the United States as of the designated settlement date.2 Currently, the only exchange/market codes that will be accepted by the system are as follows:

| Exchange/Market Code | Exchange/Market |

|---|---|

| A | New York Stock Exchange |

| B | NYSE American |

| E | NYSE Arca |

| H | Cboe BZX Exchange |

| R | NASDAQ |

| S | Over-the-Counter |

An issue's symbol should be verified to ensure that it reflects the security’s NASDAQ, NYSE, NYSE American, NYSE Arca, Cboe BZX, or OTC equity symbol as of the relevant settlement date. Issue symbols and names can be verified by accessing symbol directories on the website of the relevant exchange.

Prior to submitting a short interest position in an equity security, member firms must remove all spaces, special characters and lowercase letters from the issue symbol. Refer to the table below for some examples.

| Issue symbol with spaces/special characters | Issue symbol to be reported |

|---|---|

| ABC PRA | ABCPRA |

| ABC.PRA | ABCPRA |

| ABC.PR.A | ABCPRA |

| ABC$A | ABCPRA |

| ABCpA | ABCPRA |

In addition, please be aware of the following concerning short positions in new issues. Syndicate balances that do not represent short positions and short positions in syndicate accounts that will be covered from over allotment provisions related to the offering of that issue should be excluded from short interest reporting. Member firms are advised to establish, maintain and enforce written supervisory procedures regarding firm underwritings so as to avoid any occurrence of inaccurate reporting of this type, particularly where a member firm relies on a system-generated short interest report.

How to file: Short Position Reporting

Firms have the ability to file short interest positions using one of the following methods: manual input into the system; File Transfer Procotol (FTP); or an upload of a comma separate values (“.csv”) file. Firms may also use a service provider to file the short interest report on their behalf via FTP. A video demonstration of the web-based system is available to firms.

The system configuration requirements are as follows.

- Requires a browser supporting 128-bit encryption for the SSL connection.

- Javascript must be enabled.

- Users must be able to save encrypted files to a disk to open/save any files downloaded from the site.

- Windows 10 or higher is required if using Internet Explorer.

FINRA Short Interest FTP Format

To report a firm’s short interest data via the FTP process, the firm must create and save an ASCII text file. The FINRA record format uses four types of records. Below is a detailed description of the required file format. There should be only one occurrence of Record Types 1, 2 and 4 for each Short Interest Filing. Record Type 3 is used to report each short position.

Note: It is the firm’s responsibility to ensure that all filings it submits or are submitted on its behalf via FTP are correct. Also, multiple filings in a single FTP file are not permitted.

Record Type 1 - Firm Identification Record

Record Type 1 must always be the first row in the record submitted to FINRA. Firms must populate the first field in Record Type 1 with “A1.” Firms must also populate the SEC number and the firm number fields. These numbers must be correct or the file will be rejected.

| Field | Name | Type | Length | Positions | Format | Description |

|---|---|---|---|---|---|---|

| 1 | ID 1 | CHAR | 2 | 1-2 | "A1" | Must have the code "A1" to identify the record type |

| 2 | Firm Name | CHAR | 30 | 3-32 | Name of the firm reporting the short position | |

| 3 | Firm Number | NUMBER | 6 | 33-38 | Firm Number (may be the CRD #, FINRA # or Broker/Dealer #) | |

| 4 | SEC Number | NUMBER | 5 | 39-43 | XXXXX | SEC Number (do not include the "8-" prefix) |

| 5 | NSCC Number |

NUMBER | 4 | 44-47 | NSCC number | |

| 6 | Prepared By | CHAR | 25 | 48-72 | Name of the person to contact at the firm |

Record Type 2 - Firm Contact Record

Record Type 2 must always be the second row in the record submitted to FINRA. Firms must populate the first field in Record Type 2 with "A2." Firms must also populate the settlement date field with a valid settlement date. These fields must be correct or the file will be rejected.

| Field | Name | Type | Length | Positions | Format | Description |

|---|---|---|---|---|---|---|

| 1 | ID2 | CHAR | 2 | 1-2 | "A2" | Must have the code "A2" to identify the record type |

| 2 | Contact Number | NUMBER | 12 | 3-14 | nnn-nnn-nnnn | Telephone number at firm (include the dashes) |

| 3 | Contact Extension | NUMBER | 4 | 15-18 | Telephone extension number | |

| 4 | Contact Title | CHAR | 25 | 19-43 | Title of the Contact Person | |

| 5 | Settlement Date | DATE | 6 | 44-49 | mmddyy | Settlement date |

| 6 | Trade Date | DATE | 6 | 50-55 | mmddyy | Trade date |

| 7 | CBOE DEA | CHAR | 1 | 56-57 | "Y" | Enter "Y" if CBOE is the firm's designated examining authority |

Record Type 3 - Short Interest Data

One record of this type must be created for each short position. Firms must populate the first field in this record with the letter "B" followed by a blank space. Record Type 3 will begin at row three.

| Field | Name | Type | Length | Positions | Format | Description |

|---|---|---|---|---|---|---|

| 1 | ID3 | CHAR | 2 | 1-2 | "B " | Must have the code "B " (the letter "B" followed by a space) to identify the record type |

| 2 | Exchange | CHAR | 1 | 3 | The code supplied should represent the U.S. primary exchange or market on which the security is listed as of the designated Settlement Date | |

| 2 | Symbol | CHAR | 10 | 4-13 | Symbol for the security, left justified | |

| 3 | Security Name | CHAR | 30 | 14-43 | Name of the security, left justified | |

| 4 | Position | NUMBER | 13 | 44-56 | Short position for the security, right justified |

Record Type 4 - Trailer Record

Record type 4 must contain data identifying the total number of records in the file. The first field in this record should always be "99." Record type 4 is always the last row in the record.

| Field | Name | Type | Length | Positions | Format | Description |

|---|---|---|---|---|---|---|

| 1 | ID4 | CHAR | 2 | 1-2 | "99" | Must have the code "99" to identify the record type |

| 2 | Total Records | NUMBER | 5 | 3-7 | Total number of records in the file, including the header records, but excluding the trailer record. This should be right justified. |

Example Short Position Filing:

A1ACME SECURITIES, INC. 012345099991111JOE SMITH

A2202-555-1114 VICE PRESIDENT 101598101298

B RABCD ALPHABET SOUP CO. 0000000015500

B BXYZ END OF THE LINE INC. 0000000009950

9900004

Note: If a firm or service provider submits filings for other firms, the submitting entity MUST have been delegated SHORTS privileges by each firm for which it is submitting data. Delegation can only be performed by contacting FINRA Support Center at 301-590-6500.

Short Interest File Upload Instructions and File Format

To report short interest data via the file upload option, firms must create and save a .csv file. Below are guidelines for creating the uploading this file format, as well as a detailed description of the required file format.

File Upload Guidelines

- Using Microsoft Excel, Notepad, Notepad++ or similar editor, enter one short position per row. When adding short positions, please note the following.

- The first column in each row (column A) must contain the word “Row.”

- The text in the first two rows and in column A must not be altered, as these cells contain important information that support system processing when the .csv file is uploaded.

- Short positions that are 12 characters or longer will automatically be converted to scientific notation in certain spreadsheet editor programs. To ensure that these positions are uploaded properly, the firm has two options.

- Change the cell format to “text,” then re-enter the short position into the cell; or

- Create the file in Notepad or Notepad ++ and upload that file directly into the firm’s draft.

- Once the short positions have been added, save the file in .csv format. Firms must exit Microsoft Excel or similar editor or the .csv file will not upload properly.

- If the file is not in the valid format, i.e., it is not a .csv file, has an incorrect settlement date, or the first two rows and column A were altered, the file will be rejected.

- If the .csv file is in the acceptable format, the draft will be updated and any errors will be displayed within the draft on the screen.

Field by field detailed instructions and validations

| Field | Description | Instructions/Validations |

|---|---|---|

|

Exchange |

The exchange code supplied should represent the U.S. primary exchange or market on which the security is listed as of the designated Settlement Date. |

|

|

Symbol |

Symbol for the security |

|

|

Position |

Short position for the security |

|

Sample File Contents

SettlementDate,10/15/2015,,

Columns,exchange,symbol,position

Row,R,MSFT,123

Row,S,BRFH,550

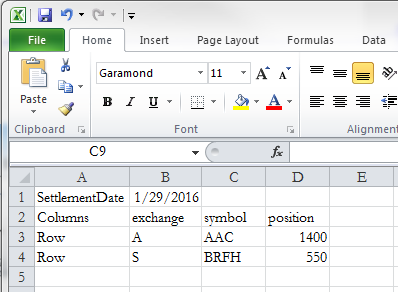

Sample File opened in Excel

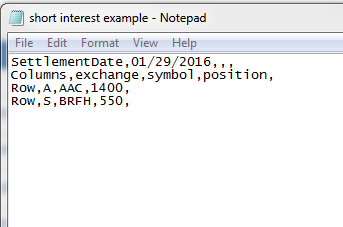

Sample File opened in a Text editor (notepad)

1 See

for a more detailed description of the system requirements.

2 It is important to note that the exchange or market on which the short sale transactions that comprise the short interest positions were executed is not relevant and should not be considered.