How Your Credit Score Impacts Your Financial Future

Many people do not know about the credit scoring system—much less their credit score—until they attempt to buy a home, take out a loan to start a business or make a major purchase. A credit score is usually a three-digit number that lenders use to help them decide whether you get a mortgage, a credit card or some other line of credit, and the interest rate you are charged for this credit. The score is a picture of you as a credit risk to the lender at the time of your application.

Each individual has his or her own credit score. If you're married, both you and your spouse will have an individual score, and if you are co-signers on a loan, both scores will be scrutinized. The riskier you appear to the lender, the less likely you will be to get credit or, if you are approved, the more that credit will cost you. In other words, you will pay more to borrow money.

Scores range from approximately 300 to 850. When it comes to locking in an interest rate, the higher your score, the better the terms of credit you are likely to receive.

Now, you probably are wondering "Where do I stand?" To answer this question, you can request your credit score (for which there is a charge) or free credit report from (877) 322-8228 or www.annualcreditreport.com.

The most well-known credit scoring system was developed by Fair Isaac Corporation and is called the FICO® score. The three major credit bureaus—Equifax®, TransUnion® and Experian®—use the FICO scoring model for their proprietary systems. Since each scoring system uses a slightly different statistical model, your score from each of the three will not be exactly the same. This is because lenders and other businesses report information to the credit reporting agencies in different ways, and the agencies may present that information through their proprietary systems differently.

Because different lenders have different criteria for making a loan, where you stand depends on which credit bureau your lender turns to for credit scores.

How Your Credit Score Affects You

Suppose you want to borrow $200,000 in the form of a fixed rate thirty-year mortgage. If your credit score is in the highest category, 760-850, a lender might charge you 3.307 percent interest for the loan.1 This means a monthly payment of $877. If, however, your credit score is in a lower range, 620-639 for example, lenders might charge you 4.869 percent that would result in a $1,061 monthly payment. Although quite respectable, the lower credit score would cost you $184 a month more for your mortgage. Over the life of the loan, you would be paying $66,343 more than if you had the best credit score. Think about what you could do with that extra $184 per month.

Determining Your Credit Score

So, how do credit bureaus determine your credit score? Fair Isaac has developed a unique scoring system for each of the three credit bureaus, taking the following five components into account:

| Component | Component Weight |

|---|---|

| Payment history | 35% |

| How much you owe | 30% |

| Length of credit history | 15% |

| Type of credit | 10% |

| New credit (inquiries) | 10% |

What Helps and Hurts a Credit Score

Here is what each component says about you:

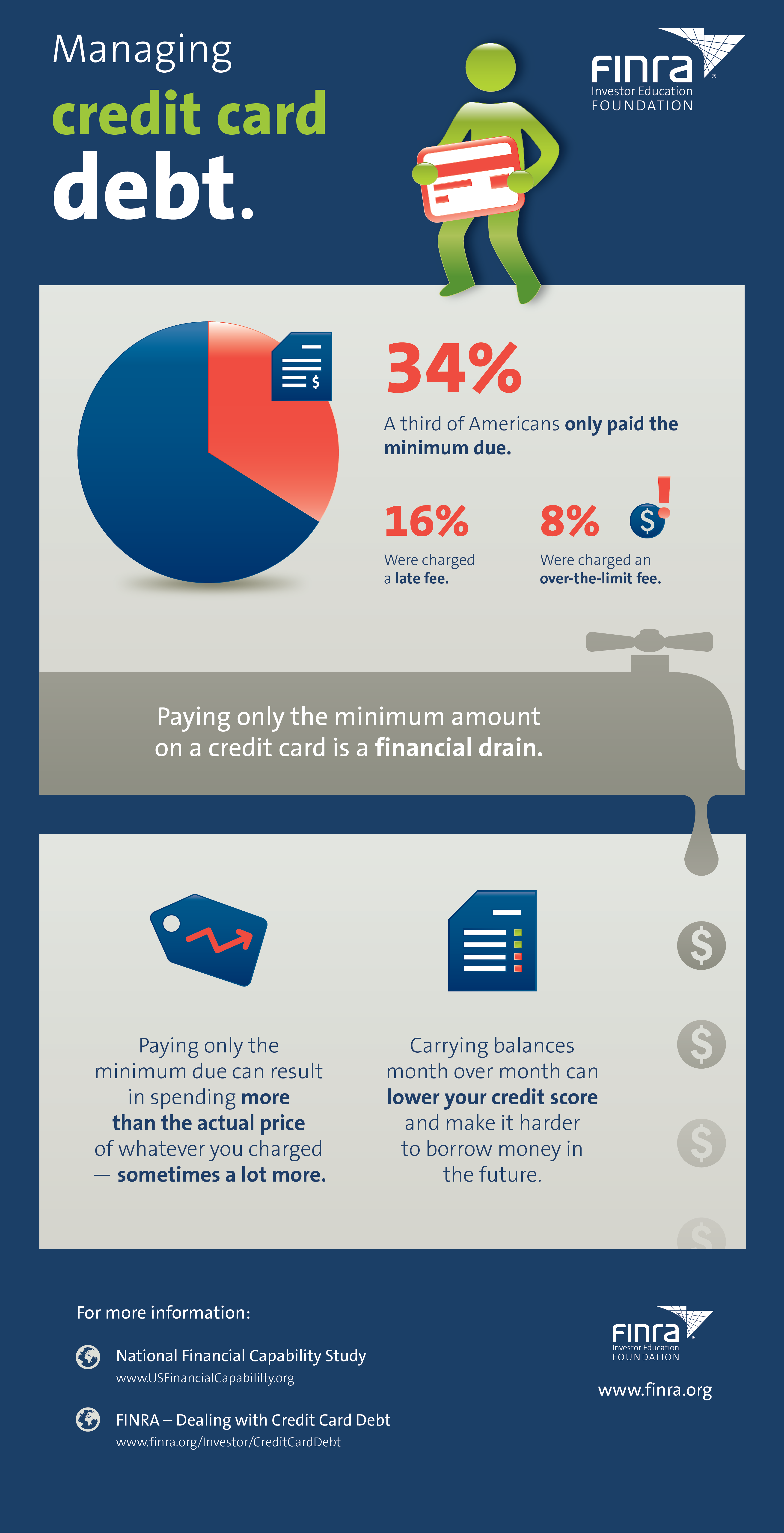

- Payment History details your track record of paying back your debts on time. This component encompasses your payments on credit cards, retail accounts, installment loans (such as automobile or student loans), finance company accounts and mortgages. Public records and reports detailing such items as bankruptcies, foreclosures, suits, liens, judgments and wage attachments also are considered. A history of prompt payments of at least the minimum amount due helps your score. Late or missed payments hurt your score.

- Amounts Owed or Credit Utilization reveals how deeply in debt you are and contributes to determining if you can handle what you owe. If you have high outstanding balances or are nearly "maxed out" on your credit cards, your credit score will be negatively affected. A good rule of thumb is not to exceed 30% of the credit limit on a credit card. Paying down an installment loan is looked upon with favor. For example, if you borrowed $20,000 to buy a car and have paid back $5,000 of it on time, even though you still owe a considerable amount on the original loan, your payment pattern to date demonstrates responsible debt management, which favorably affects your credit score.

- Length of Credit History refers to how long you have had and used credit. The longer your history of responsible credit management, the better your score will be because lenders have a better opportunity to see your repayment pattern. If you have paid on time, every time, then you will look particularly good in this area.

- Type of Credit concerns the "mix" of credit you access, including credit cards, retail accounts, installment loans, finance company accounts and mortgage loans. You do not have to have each type of account. Instead, this factor considers the various types of credit you have and whether you use that credit appropriately. For example, using a credit card to purchase a boat could hurt your score.

- New Credit (Inquiries) suggests that you have or are about to take on more debt. Opening many credit accounts in a short amount of time can be riskier, especially for people who do not have a long-established credit history. Each time you apply for a new line of credit, that application counts as an inquiry or a "hard" hit. When you rate shop for a mortgage or a car loan, there may be multiple inquiries. However, because you are looking for only one loan, inquiries of this sort in any 14-day period count as a single hard hit. By contrast, applying for numerous credit cards in a short period of time will count as multiple hard hits and potentially lower your score. "Soft" hits—including your personal request for your credit report, requests from lenders to make you "pre-approved" credit offers and those coming from employers -will not affect your score.

Good Credit Puts Money in Your Pocket

Good credit management leads to higher credit scores, which in turn lowers your cost to borrow. Living within your means, using debt wisely and paying all bills—including credit card minimum payments—on time, every time are smart financial moves. They help improve your credit score, reduce the amount you pay for the money you borrow and put more money in your pocket to save and invest.

1 Scores and rates as of January 9, 2015, as reported on myFICO website.